Consumer Alert: Senators Try to Delineate Reverse and Mileage Legislation as Pending Bill

For fans of Points and Miles, the bad news is: Some U.S. senators are trying to use the Credit Card Competition as a “poison” amendment, a “poison” amendment to vote in Congress.

Sen. Roger Marshall, a Republican from Kansas, filed an amendment last week on behalf of himself and Illinois Democrat, Sen. Dick Durbin, to add the CCCA to the guidance and establishment of national instruments in the U.S. Stablecoins Act.

The Genius Act received bipartisan support and initially it seemed to have surpassed the Senate with a key threshold of 60 votes. Supporters of the legislation claim it will allow better regulation of the cryptocurrency market and provide greater stability in the digital currency market overall.

Senate Majority Leader John Thune allowed amendments to the bill, which opened up the possibility that the CCCA would be attached to the bill if the senators voted to approve the addition. However, at least one senator said he would withdraw his support for the Genius Act if the CCCA is ultimately attached.

“If this is adopted in genius, I will withdraw the Senate support,” said Senator Thom Tillis, a Republican of North Carolina, according to Washington Reporter.

Several other senators called for a “cleaning” genius bill without amendments.

These include Cynthia Lummis, a Republican from Wyoming, and Bill Hagerty, a Tennessee Republican.

Vice President JD Vance also demanded that there be no legislation accompanying the CCCA be voted “clean”.

Unfortunately, if Marshall and Durbin succeed and the Senate votes to approve the amendment, they will join the CCCA. This would force senators to choose between opposing otherwise popular legislation to avoid passing controversial amendments or allowing all bills to pass and deal with the consequences of CCCA.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

Tell Congress not to take your credit card rewards: Protect your opinion

“This is a political favor [the bill’s] The biggest campaign donor for supporters.

The Electronic Payment Alliance is a trade association representing credit unions, community banks and payment card networks.

“The bill never passed the relevant committee, was never debated, and was never even reintroduced to the Congress,” Hunter said. “Unlike the sponsors of the Genius Act, Durbin Marshall’s sponsors,” he said. [the Credit Card Competition Act] No due diligence was conducted. ”

TPG strongly opposes CCCA because we believe this will undermine the consumer-friendly benefits of credit cards.

What is the “Credit Card Competition Law”?

The CCCA puts price control on swap fees, which can actually eliminate the profitable registration bonus and points capability of many banks, airlines and hotel credit cards.

When similar legislation was passed on debit cards in 2010, consumers promised lower goods and services, as smaller debit card transaction fees would pass them to consumers at lower prices. That didn’t happen. Instead, the points and registration bonuses on these cards disappeared and the prices rose.

A study by the International Center for Law and Economics estimates that exchange fees caps for debit transactions are large banks reaching between $660 and $8 billion in annual revenue. This loss of income directly leads to a reduction in the reduction of free checking accounts and reward programs.

Electronic Payment Alliance Tell TPG, “The Durbin-Marshall Act allows companies such as Walmart, Target and Home Depot to choose the cheapest credit card processing option without considering consumer safety or benefits.”

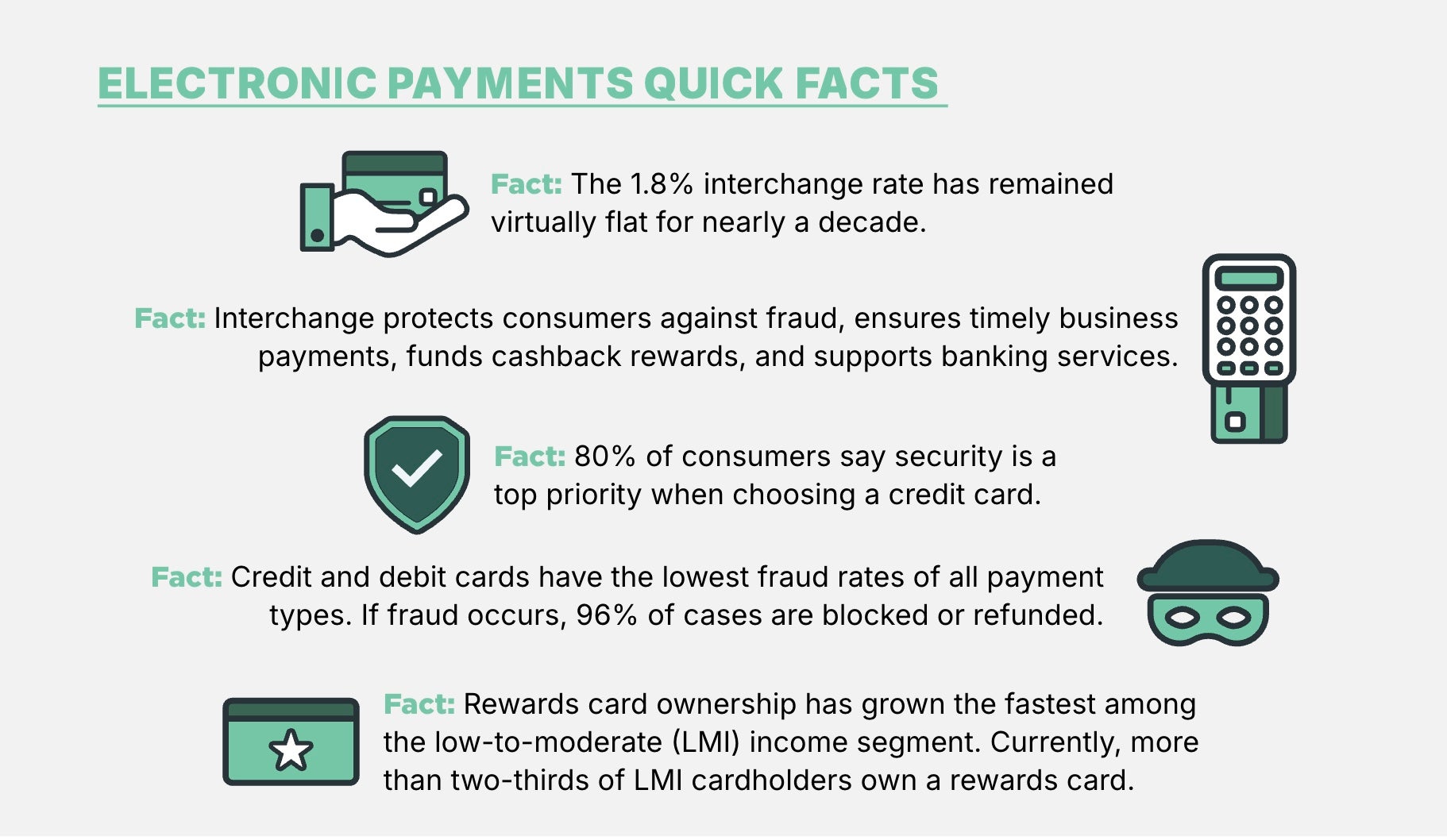

The Electronic Payment Alliance also states:

- The bill could force unproven networks on transactions, weaken fraud protections and raise costs for businesses and consumers.

- It threatens credit card rewards, including cashback benefits, that can help consumers fight inflation and benefit small businesses.

- Small businesses may face higher costs, while accepting card payments will be less profitable.

Research shows that the bill could also lead to a slowdown in the U.S. economy, with economic losses and about $156,000 in unemployment jobs.

A study from the University of Miami found that the CCCA would significantly reduce the income of community banks and credit unions, while also reducing access to credit and banking services in smaller markets across the country, with a disproportionate impact on rural and low-income households.

Since a company is based partly on the principle of using a credit card rewards program to help save travel money, TPG is one of many organizations with vested interests in the cause.

There are a variety of organizations and industries in all 50 states, policy agencies, trade associations, thought tanks and airlines, including labor unions, small business owners, financial institutions such as credit unions and community banks.

How to help protect your opinion

As we work with TPG’s main credit card issuers, our staff and millions of readers have witnessed first-hand how the reward program unlocks travel that would otherwise be untouchable. By making travel more accessible, we can help readers broaden their horizons, open their minds and experience different cultures – all of which will be jeopardized if the CCCA is allowed as an amendment to the Genius Act.

“This is disastrous for consumers,” said TPG founder Brian Kelly. “… [They] Rewards, purchase protection and fraud protection will be lost, and retailers will increase their most important. ”

In partnership with the Electronic Payment Alliance, TPG launched a platform for TPG readers to express opposition to the bill to their local representatives and senators.

Click this link to submit a quick form. Please spend 30 seconds today telling your senators to vote on the CCCA Amendment to the Genius Act.

Related readings: