Why don’t I think I need a shared hotel credit card

For over a decade, I’ve been involved in the world of points and miles and I’ve never applied for a shared hotel credit card. While this may surprise most people, my travel habits don’t need me to need one.

Although I travel about 100,000 miles a year, I don’t stick to a hotel brand and am very open to the brands I choose to stay. When I booked a hotel, I focused on the uniqueness of the price, location and property. This makes me open to all brands, but I tend to have no loyalty programs to eventually get in.

This is the main reason why I don’t need a hotel credit card with a common brand and how to manage to get it to work with the current credit card in my wallet.

I’m not loyal to 1 brand

When most people think of hotel brands, they tend to focus on three main brands: Marriott, Hilton and Hyatt. These brands have several types of hotels in their portfolio, ranging from budget to expansion sites to high-end properties.

When booking an international or international travel property, I have considered various factors including price, rating, location and amenities.

Sometimes, since it has the largest hotel portfolio, I end up in the Marriott Hotel. But 75% of the time, the Marriott hotel is not in my chosen location (or the price is appropriate).

I don’t think the important reason why a hotel credit card with a common brand is that most properties I stay on have no loyalty ecosystem. These characteristics include four seasons, namely Mandarin Oriental, Rosewood, Oman and Unique.

Frankly, I go specifically to certain destinations because the brands mentioned above tend to have unique and luxurious features. These attributes offer certain services, facilities, personalization and quality that are hard to beat even in top properties with brands that offer common credit cards.

For example, there are some of the industry’s most comfortable mattresses in the four seasons, so much so that it even sells them. I travel with my family often and whenever these brands see a reservation for a little kid, they almost always provide convenience and special gifts.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

Because the hotel brands I stayed behind vary, it was more beneficial for me to use Chase SapphireReserve® (see Rates and Fees) to earn a purchase that cost 3 points per dollar. Later, I will redeem these points by transferring to Chase’s 11 airline partners.

On top of that, the Sapphire Reserve offers a flexible annual travel credit of $300, which can be applied to any code of the travel code, so that credit can be automatically applied to any hotel purchase. In the past, after my $300 credit reset, I called the hotel and asked the property to charge my sapphire reserve for $300 and use my credit immediately.

Related: Chase Sapphire Reserve Credit Card Review: Luxury Goods and Valuable Rewards

I’m worried about the depreciation of the program

This may be surprising, but I currently have a Platinum Elite status in the Marriott Hotel program. I make money organically with paid accommodation and maximizing Marriott promotions to earn reward nights after a double elite nightfall or a qualified stay.

Marriott Hotel always conducts double-night promotions from February to April every year, and every paid night will bring you the awards of Elite Night. To obtain Marriott Bonvoy® Platinum Elite status, you will need to stay 50 nights within a calendar year. During the two-night promotion I stayed for about 15 to 20 nights, which made me earn 30 to 40 nights immediately.

But, like airlines’ frequent flyer programs, hotel loyalty programs suffer from depreciation. Earlier this year, TPG calculated the value of Bonvoy Marriott hotels fell, with the index remaining among properties around the world.

By opening a common hotel credit card, I will make a long-term investment in the program. I linked myself to the hotel plan, stayed almost entirely on the brand and bought it with the brand’s cards, which would give me bonus points.

Points earned on shared-brand hotel credit cards are also low. For example, according to TPG’s May 2025 valuation, Marriott Hotel’s points are worth 0.7 cents. On the other hand, the transferable points for programs such as Chase Ultimate Rewards and American Express membership rewards are 2.05 and 2 cents respectively.

When I first started collecting points and miles ten years ago, Marriott had a fixed rewards table that maximized redemption. For example, Ritz-Carlton of Dubai International Financial Centre spent only 200,000 Bonvoy points during the 2019 New Year, partly because the fifth night was free. The same property will exceed 400,000 points this year, with a 200% increase in costs.

In my experience, the depreciation of hotel plans is much worse than that of airline plans.

Related: Marriott Bonvoy greatly increases some reward costs

Dynamic pricing

Currently, Marriott and Hilton offer dynamic pricing for redemptions, while Hyatt offers reward tables with off-peak, standard and peak rates.

Although Hyatt has recently moved hotels to many properties categories, it remains a favorite among TPG employees and points enthusiasts due to the published rewards list. You can redeeate one night between 35,000 and 45,000 a night (off-peak) or splurge on Category 8 properties. The only downside is that its global footprint is not as big as other hotel brands.

Hilton and Marriott are a completely different story. Due to the huge number of points required to get along with these brands, saving points for an ideal accommodation can take some time.

I have nearly 800,000 Bonvoy points in my hotel stays with the Marriott brand for several years. Whenever I think of redeeming them, it is hard to lower the change in hotel categories or the higher priced cash rate.

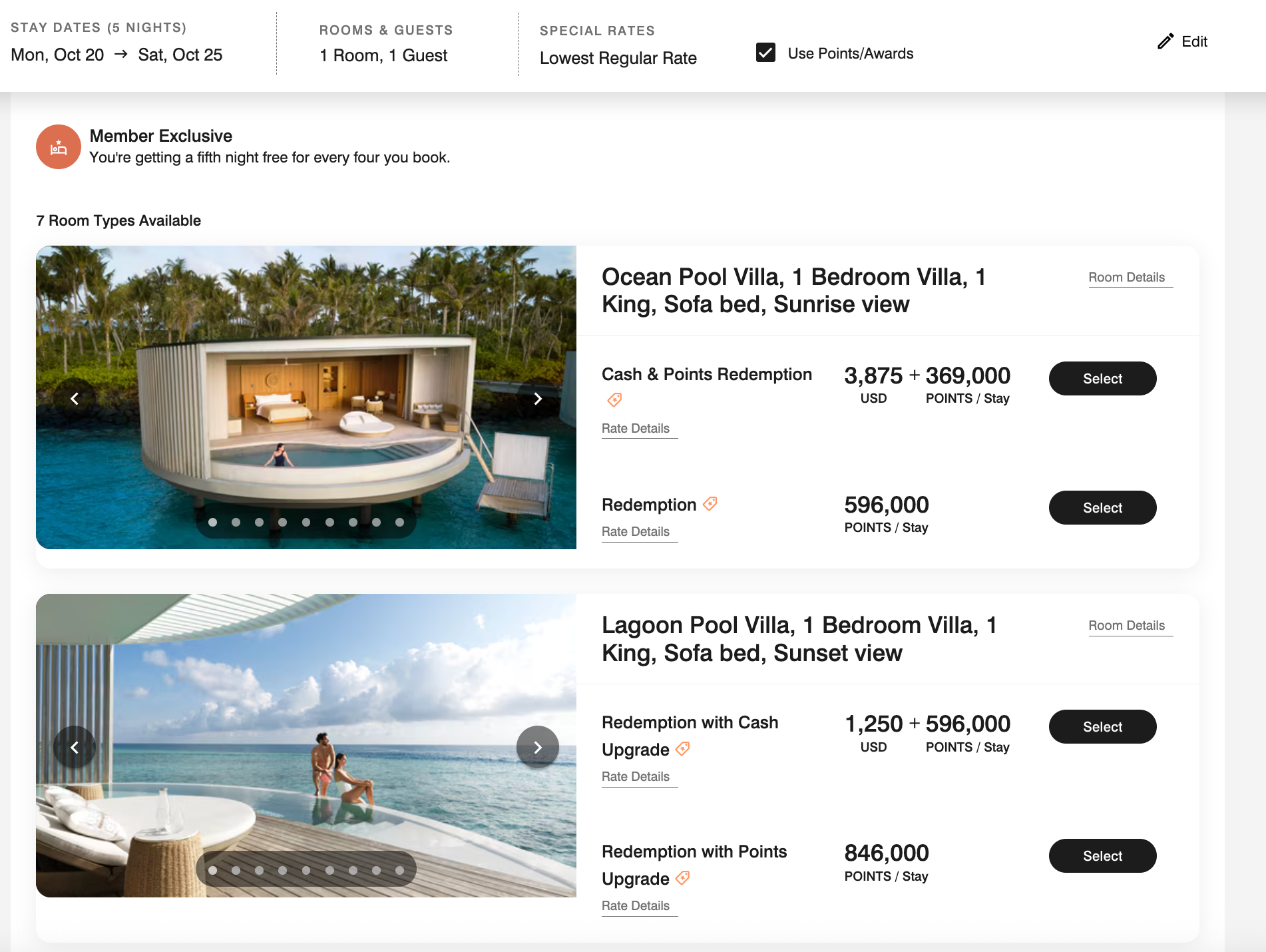

For example, I have been following Ritz-Carlton Maldives in the Fari Islands for a while. Stayed in the Ocean Pool Villa for five nights, and the price is 596,000, while a similar stay in the Lagoon Pool Villa will also get you back 846,000. Both options still require over $2,000 in seaplane transfers and some taxes in cash.

The cash rate for the same accommodation in the Ocean Pool Villa is $11,675, which makes our value points about 1.95 cents, almost triple the MARRIOTT points based on TPG’s May 2025 valuation. According to TPG’s May 2025 valuation, the Lagoon Pool Villa will give you a return of $13,206, worth about 1.56 cents per point. While these are good deals, it may take a while for Marriott cardholders to accumulate a lot of points.

If I own a Marriott Bonvoy Brillight® American Express® card and try to collect points only through hotel spending, I have to accumulate a $28,380 fee on the Marriott property to make the Maldives redemption come true. My expenses are based on 6 points spent on Marriott purchases per dollar and 15 points spent on most real estates due to their Platinum Elite status.

This will give me enough points to cash in on the redemption I want, but that’s quite a bit of the expense (much higher than the room cost). Not to mention, you may suffer another devaluation.

Related: Stay at these amazing Ritz-Carltons around the world

I prefer to earn transferable rewards

Given the depreciation of the hotel program, I prefer to receive transferable rewards and specific brand rewards through a common brand hotel card.

My favorite travel credit card is my sapphire reserve because it costs 3 points per dollar on the purchase code, including the hotel. According to TPG’s May 2025 valuation, Chase Ultimate Rewards points are worth 2.05 cents.

Chase Ultimate Rewards points transferred to 11 airlines and 3 hotel plans, making me flexible when using my perspective. I don’t have to worry about chasing points being depreciated, and the issuer rarely contacts with transfer partners.

By earning transferable points, I can easily transfer my points to the airline to experience the products of Qatar Airways QSuite, Etihad’s top-notch apartments (via Air Canada Aeroplan) or all Japanese airlines.

Recently, TPG’s credit card writer Chris Nelson has proposed a compelling case about why he never pays for his hotel with a shared credit card, and I agree with him.

Thanks to my Platinum Elite I earned 15 points per dollar on property at the most Marriott hotels, which gave me a 10.5% return on purchases. While this may seem large, remember that according to TPG’s May 2025 valuation, Marriott’s points are worth 0.7 cents, about one-third of the value of Chase Ultimate Rewards points.

I have other ways to enjoy the Elitelike allowance

The biggest benefit of a shared brand hotel credit card is the ability to have an instant elite identity or a way to make money.

For example, Hilton Honors American Express Aspire Card offers card members Hilton Diamond Status, offering room upgrades, on-site food and Oktoberfest credits and getting hotel executive lounges.

Hilton Honors US Express Aspire Card information has been independently collected by Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Some would say that instant top elite identity makes a card worthwhile, but I think the number of elite members with hotel plans makes the most needed benefits (like Room upgrades) hard to get.

I could use Elitelike’s privileges without having a Cobrand Hotel credit card, thanks to shows like American Express Fine Hotels + Resorts and editing from ChaseTravel℠. When booking a qualified property, these plans can provide breakfast for up to two guests, room upgrades, property credit, early check-in, evening checkout and welcome facilities.

Another way I earn Elitelike Perks is by using a professional travel agency. These travel agencies are part of a unique program, with their top brands offering similar or better privileges than Amex Fine Hotels + Resorts as well as editors and expectations of these programs.

If a travel agency is the preferred partner for four seasons, Rosewood Elite Partner, AMAN Partner, or affiliation with another similar partner program, you can expect unique prices, offers and Elitelike privileges.

On a recent trip to Tokyo, I was upgraded to a suite at the Otemachi Four Seasons Hotel and received $200 in property credit and offered early check-in and party checkout. In my experience, these programs are more consistent in providing privileges than hotel elite identities.

Related: Otemachi Four Seasons Hotel Tokyo: Ultra-modern hotel in a historic community

Bottom line

It’s been nearly a decade since I started using points and miles, and I still don’t have a shared hotel credit card. I wanted to earn transferable points and have the flexibility of a brand I chose to stay, plus the free night cost that kept me from needing one.

Overall, my growing interest in brands without a loyalty program (think: four seasons, Mandarin Oriental and Rosewood etc) are the main drivers of my absence from getting a hotel credit card. From the point of view, I benefited more from the transferable points because I tend to use them to book premium cabin tickets.

Despite not having a hotel credit card, I still earned my status with Marriott through paid accommodation and booked through a special program with a travel agency and booked through an identity. Unless there is a significant negative change in my transferable rewards credit card, I will continue to have no hotel credit card.

Related: Best Travel Rewards Credit Card