Security Wing Review (updated in 2025)

Budget travelers love saving money – myself included. But one of the costs we shouldn’t be cheap is travel insurance.

After more than 17 years of environment, I still never leave my home.

Why?

Because I’ve seen firsthand how it works and how much money it can save.

I lost my luggage, damaged my camera, and even needed emergency medical help.

Travel insurance is with me every time. Not only did it save me money, it also provided me with peace of mind as I explored.

Over the years, I have written a lot about why you need insurance, how to choose the right company and list my preferred provider.

Today, I want to talk about mine Favorite Travel Insurance Company: Security Wing.

Who is the Security Wing?

SafetyWing is an insurance company focusing on affordable coverage for budget travelers and digital nomads (although you don’t have to get coverage). It is run by nomads and expats who know exactly what travelers need.

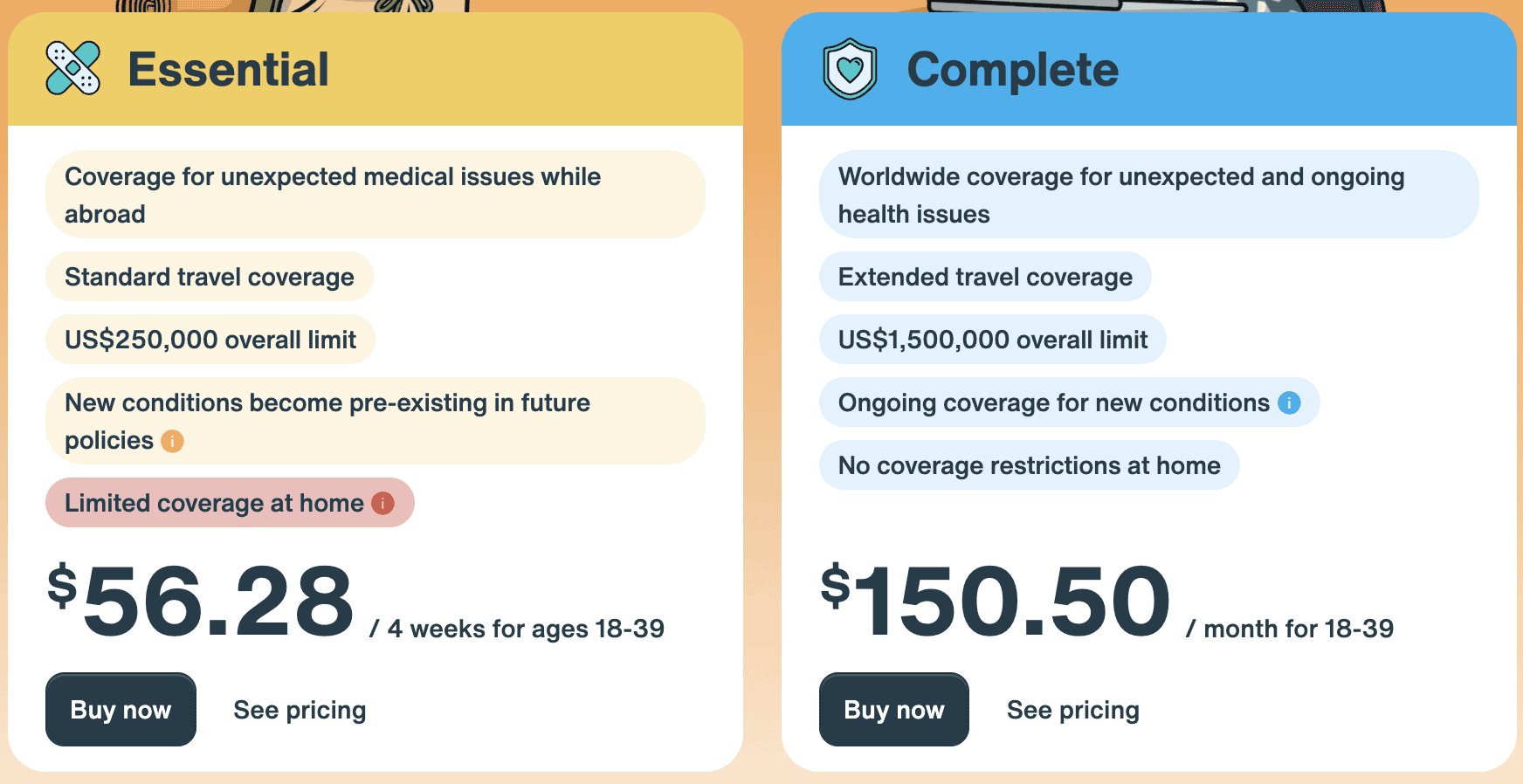

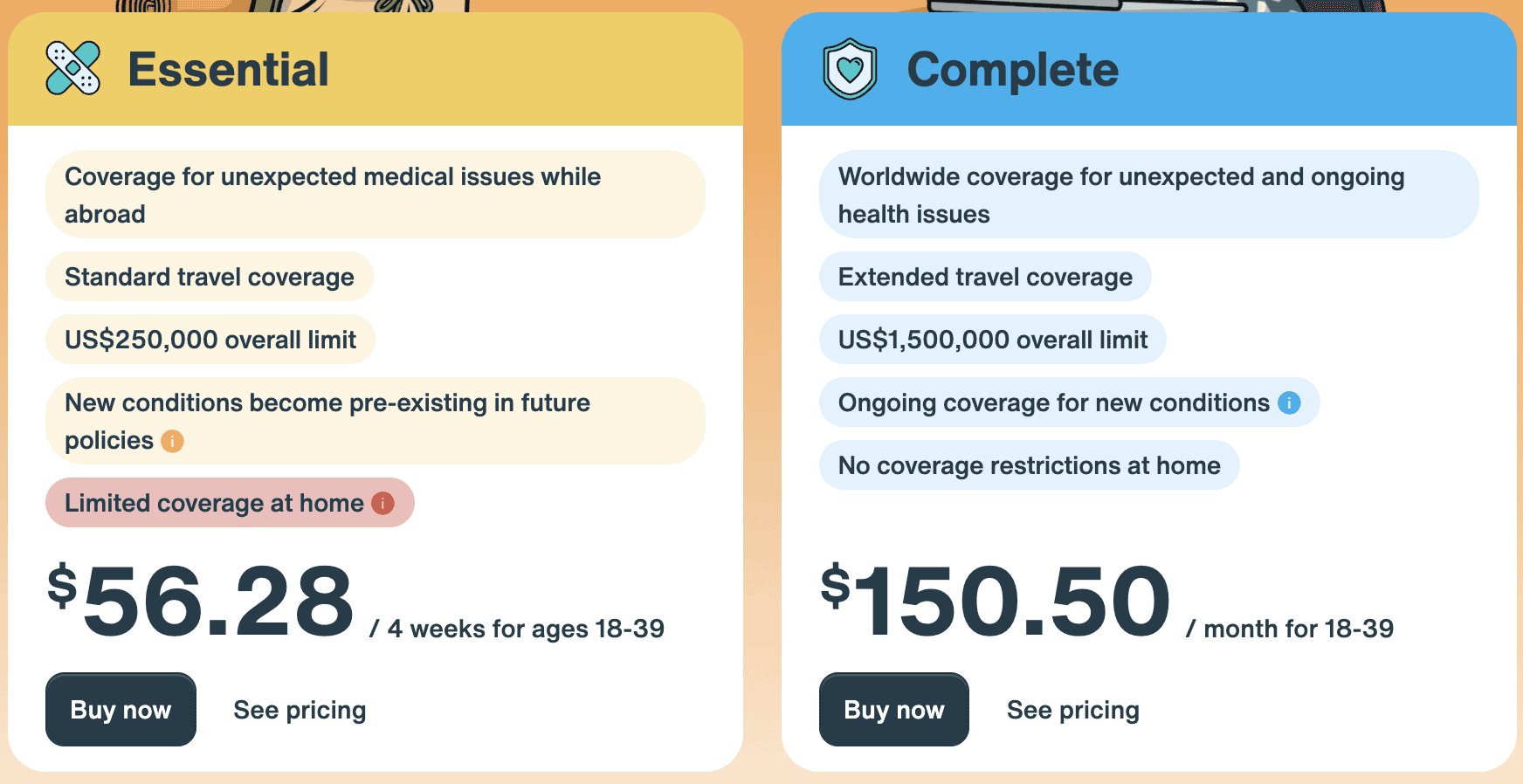

SafetyWing offers a basic insurance plan (called “Nomad Essential”), but a small percentage of other companies charges also offer incomplete charges. For me, they are the best overall travel insurance companies out there.

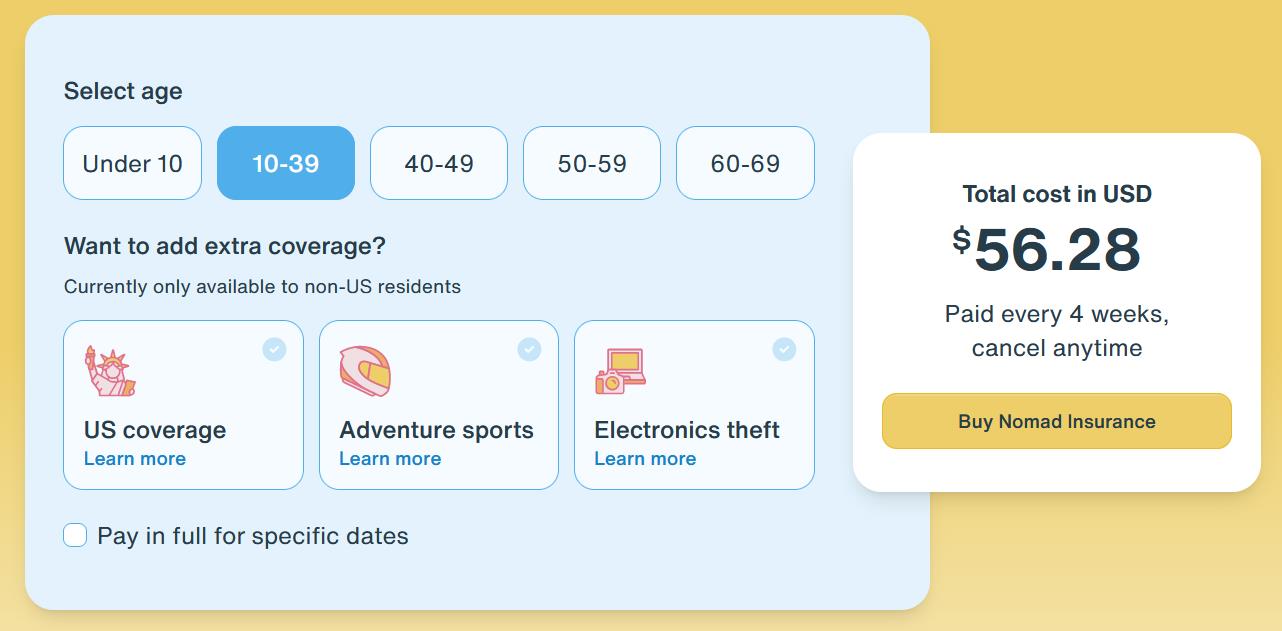

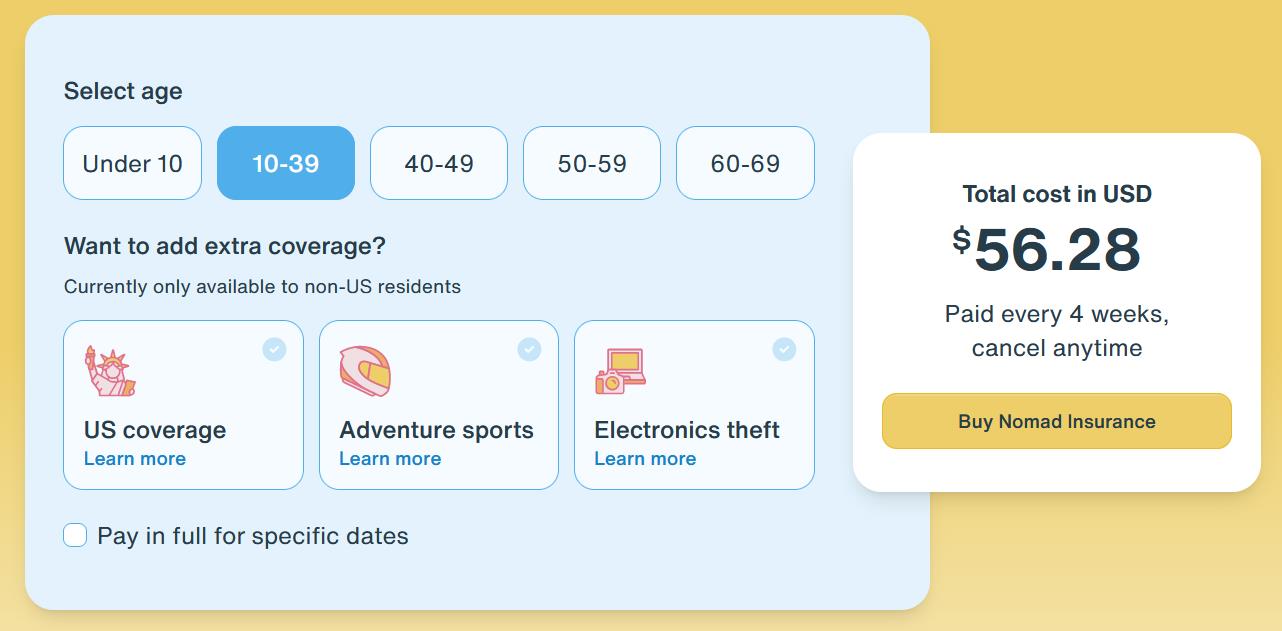

Their standard Nomad insurance coverage is only $56.28 for 4 weeks (for travelers aged 10-39). This is one of the lowest prices for reliable travel insurance. They are super competitive when it comes to price.

Their coverage has been extended to 69 years old, however, travelers aged 60-69 should expect to pay more than $196 per month for coverage. Honestly, it’s still reasonable.

But it’s coverage In fact OK? What about customer service?

Today, I want to review the Department of Safety and talk about when (and not) it is worth using so you can better prepare for your next trip and make sure you have the coverage you need.

What does the safety wing cover?

Safetywing’s standard nomadic insurance plan is the basic plan. The four-week trip (outside the United States) is only $56.28. Just $1.87 per day!

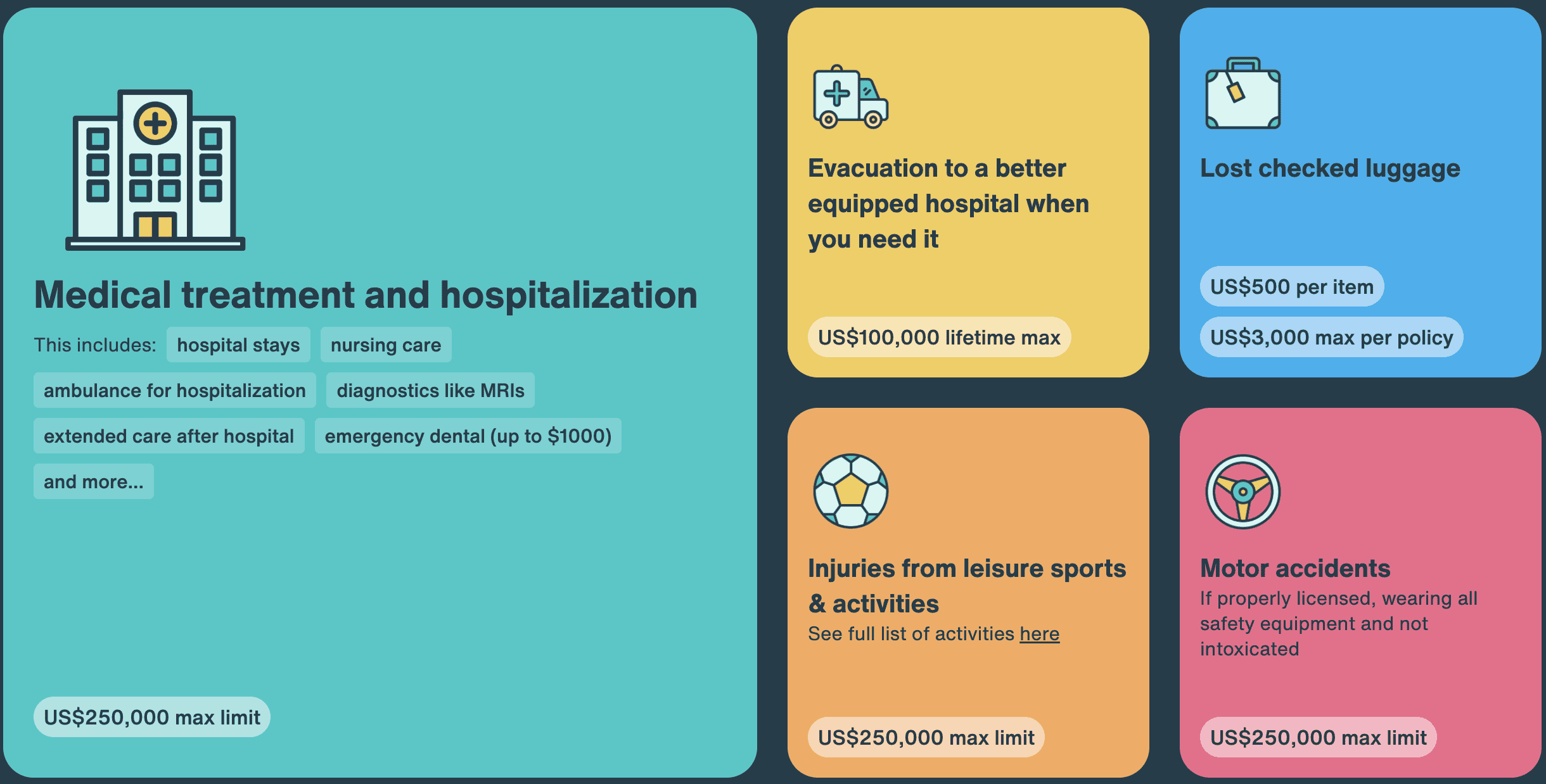

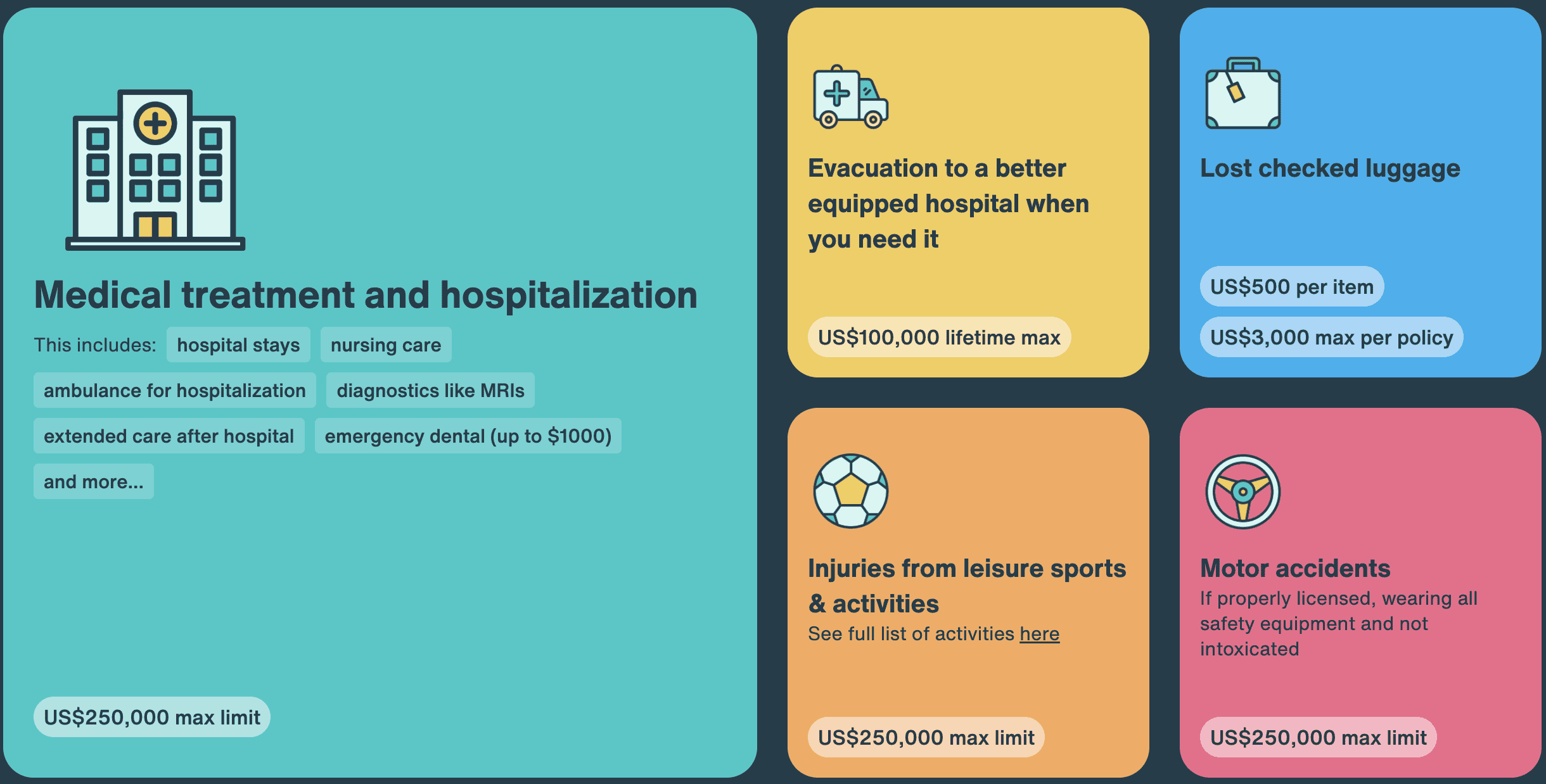

For travelers under 64, the program includes the following:

- Emergency Medicare $250,000

- Emergency Dental Care $1,000

- $100,000 for medical evacuation ($25,000 if the cause of medical evacuation is an acute attack of a pre-existing disease)

- $10,000 withdrawal due to political unrest

- $5,000 for travel interruptions

- After a 12-hour delay, up to $100 a day, unplanned overnight stays are required. Up to 2 days.

- $12,500–$25,000 in death or dismemberment

- $20,000 for repatriation of remains

Make sure to check the description of coverage to understand any conditions applicable.

Its medical evacuation of $100,000 is at the low end, but unless you go into remote wilderness, this should be fine. (Get MEDJET if you want higher coverage.)

Its travel-delay spending is pretty low, but airlines and most travel credit cards also offer travel delay assistance, so you don’t even need the coverage provided by the Security Wing. Also, it doesn’t actually cover expensive electronics, which can be awful if you have an expensive camera or video gear.

Like most standard travel insurance plans, this plan does not include pre-existing conditions or certain adventure sports, so if you are going to have a lot of adventures on the go, that’s not a good policy.

They do offer some useful add-ons that I think a lot of travelers will love, including reports on adventures and electronic theft. This means that if you need coverage, you can pay an extra fee for it. But if you don’t need it, you don’t have to pay for it and keep it cheap. I appreciate it because someone who always needs electronic coverage but doesn’t need adventure (I’m not a big adrenaline addict).

What is not covered?

The basic plan is primarily intended to cover medical emergencies and basic travel (such as delays and lost luggage). This is something no cover:

- Alcohol or drug-related events.

- Extreme Sports & Adventures (Unless you purchased an Adventure Sports Add-on for non-US residents,

- Pre-existing conditions or general inspections

- Travel Cancellation

- Loss or stolen cash

Nomad Complete: Coverage for Digital Nomads and Long-term Travelers

In 2023, SafetyWing launched Nomad Health (now known as the “Full” program). It is insurance for digital nomads, remote workers and long-term travelers. The new program provides a combination of standard emergency coverage we discussed above and a “regular” healthcare range such as routine access and preventive care.

The complete program also offers coverage in 175 countries, including health benefits, mental health care, and the ability of an individual to choose their own doctor while traveling. They will also expand coverage to include add-ons for “electronic theft” (as someone who got robbed while traveling, I think it’s a good idea).

It’s like the health insurance you find in your home country, and you can take care of you no matter what happens when you’re abroad.

You can learn more here and compare plans here.

If you’re just heading for weeks or months, then the basic plan for Safetywing is your choice. It’s perfect for emergencies, is super affordable, and is designed for travelers on a budget. This is the plan I use when traveling these days.

But if you are working abroad or traveling for months (or years), their new plan is a better choice. It offers more coverage while still affordable. Actually, this is my plan for a long-term trip!

You can learn more about the full plan in my dedicated comments.

Make a request

Security Wing makes it easy to file a claim through an online portal. You just upload all the required documents, screenshots and photos and wait for the resounding. While the claim can take up to 45 working days, most people process it in less than a week (the average waiting time is four days when writing).

If you read the review online, most people with negative experience don’t understand the deductible (Safety Wing revokes their deductibles for non-U.S. residents in 2024), or hates the time it takes to pay. But this is normal for people to complain.

On the plus side, Safetywing’s average time to process claims is reduced by four days. That’s it Way Faster than most companies!

Comments about Covid

The safety wing does include coverage for COVID-19. The virus will be covered as long as your plan does not shrink before it begins (as long as it is medically necessary).

The Security Wing also includes a $50 quarantine fee per day (outside your home country) of 10 days (provided that you already have a plan of at least 28 days).

Pros and cons of safety wing

Here is a look at the pros and cons of the safety wing that can help you determine if it is the best insurance provider for you and your trip:

The most affordable travel insurance there

Covering only 69 years old

Provide coverage for Covid-19

Limited coverage of gears/electronics

You can buy plans online, even if you already

travel

Adventure activities have limited coverage

Easy to submit claims online

No travel cancellation coverage

After 90 days of going abroad, you will remain

30 days of medical insurance at home

Country (15 days if you are from the United States)

Up to 2 children per family

(1 per adult) can be included for free

No need to set an end date (subscribe

Updated every 4 weeks)

Two different plans mean you can easily find one that suits you/your budget

Who is the security wing OK – and not good for?

The design of the safety wing is mainly medical insurance. Since Safetywing is designed for budget-conscious digital nomads, it cannot cover certain areas that may be more important for shorter travelers. Here is a quick chart to help you determine if the safety wing is right for you:

Budget travelers

People traveling with lots of electronics

Someone is looking for simple emergency coverage

Anyone who needs a full travel delay

Or cancel

There aren’t many expensive electronics

People engage in excessive extreme sports/activity

Digital nomads who need medical insurance

Long-term travel

Travel insurance is something I will never leave home. I know it’s a boring topic that can be read and researched, but can actually save you hundreds or thousands of dollars on your bill! I never left home without it. Nor should you.

So, next time you get on the road, consider the safety wing. For me, they are the best travel insurance company for travelers on a budget.

You can get a quote using the booking widget below (free):

Book your trip: Logistics Tips and Tips

Book your flight

Use Skyscanner to find cheap flights. This is my favorite search engine because it searches websites and airlines around the world, so you always know that no stone is being dragged down.

Book your stay

You can book a hotel using HostelWorld. If you want to stay outside a hotel, use Booking.com as it always returns to the cheapest prices for hotels and hotels.

Don’t forget travel insurance

Travel insurance will protect you from illness, injury, theft and cancellation. This is comprehensive protection in case something goes wrong. I’ve never been on a trip because I had to use it many times in the past. My favorite companies that provide the best service and value are:

Want to travel for free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation without any additional expenses. Check out my guide to selecting the right card and current favorites to get started and see the latest best deals.

Need to rent a car?

Discover Cars is a budget-friendly international car rental website. No matter where you go, they can find the best and cheapest rent for your trip!

Need help finding travel activities?

Get the guide is a huge online marketplace where you can find cool hikes, fun trips, skipped tickets, private guides and more.

Ready to book your trip?

Check out my resource page to get the best company you want to use when you travel. I list all the uses I used when traveling. They are the best in the classroom and you can’t go wrong with using them on the go.