Fashion Bomb Couple: Megan You Stallion in Off-White Dress with Klay Thompson at Pete and Thomas Foundation Party

Megan Thee’s stallion made his appearance at the Pete and Thomas Foundation gala, with the appearance of the black look. The fitted gown has a backless neckline with dramatic keyhole cutouts and intricately decorated with red and silver beads on the hips, showing the edges and elegance in a true Meghan style.

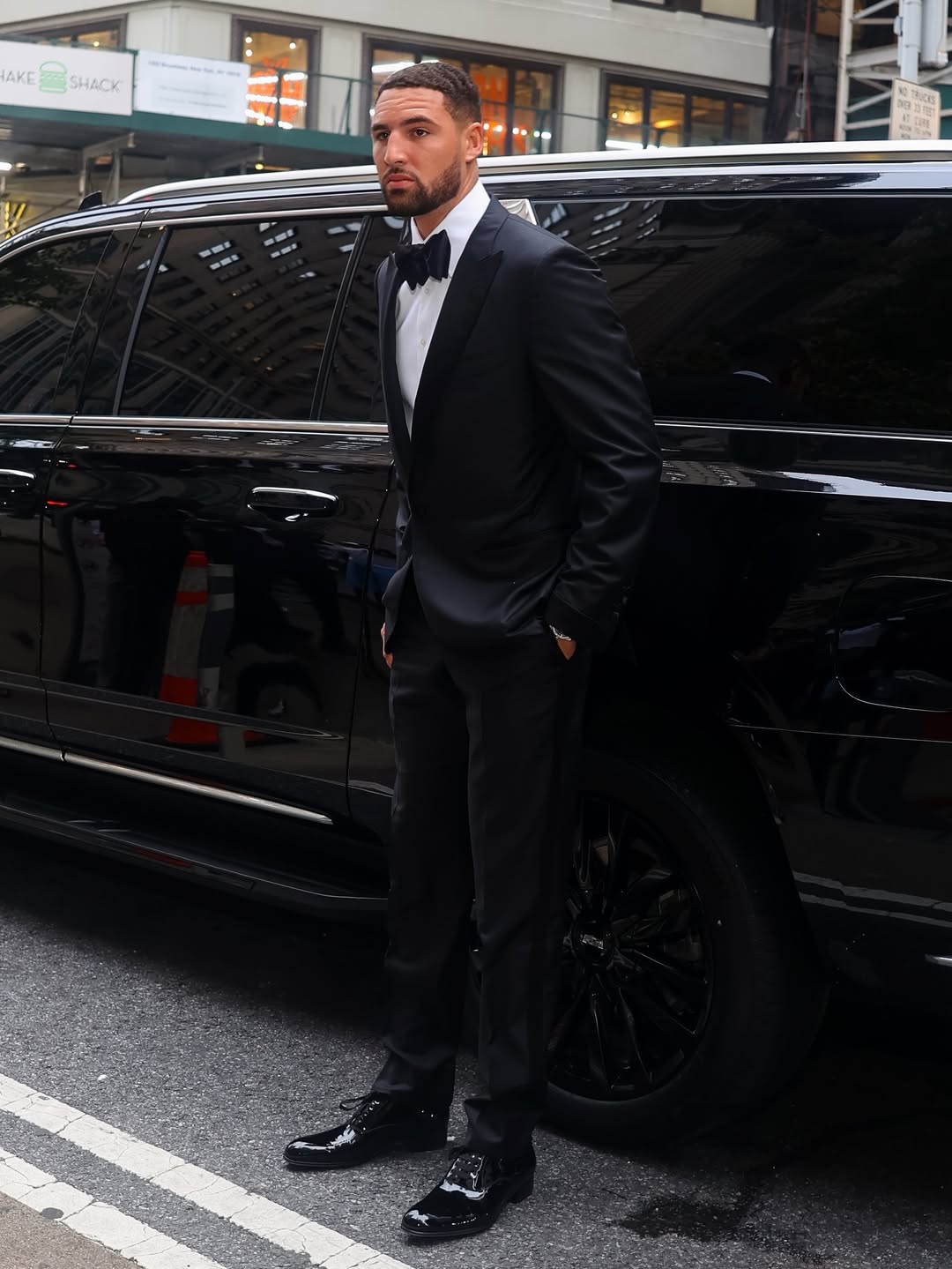

The rapper is accompanied by her new beauty NBA star Klay Thompson, who looks equally polished in a classic black tuxedo. The two participated in a couple, smiling and shaking hands as they entered a highly anticipated event, immediately becoming one of the most watched moments of the night.

The evening party commemorating community influence and philanthropy is not lacking in star power, but Megan and Klay undeniably caught the attention.

Are you here to participate in the off-white killing of this new couple and Megan?

how do you say? Hot! Or huh…?

📸: @markredstudios/Fresh Made