Chase’s Reward: How to Maximize Cash Back

If Chase’s reward hasn’t been on your radar for a while, it may be worth learning from this redemption option.

Not only does the option continue to expand to a wider list of chase cards, but some redemption rates are not meant to be sneezed.

Chase Aeroplan® Credit Card (See rates and fees) and Marriott Hotel BonvoyBold® Credit Card (See rates and fees).

Many of these current offers are valid until September 30.

Here is everything you need to know about using Chase.

Does Chase pay back the money?

In 2020, when most of the world are not traveling, Chase introduces the ongoing redemption options in its ultimate rewards program to allow card members to replace travel redemption points. These categories have evolved over time, but the core purpose of the program remains the same.

In short, repaying one’s own option allows many cardholders to use points similar to the redemption value of booking a trip. This usually doesn’t give your final reward points the same maximum, and the strategic use of the transfer partner can be obtained.

However, if you are looking for a simple redemption or have a bunch of points that won’t work immediately, this may be a good choice.

There are some airline cards now qualifying for their own eligibility and you can redeemed certain categories for more than the average you might get when booking a trip with the rewards.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

Related: The Best Chase Credit Cards

Which purchases are eligible to repay their own qualifications?

Here are the current categories that are eligible to reply to themselves:

| card | Redemption value | Current end date |

|---|---|---|

| Choosing a charity: 1.5 cents per point

Gas stations, groceries, home renovation shops and cardholders annual fee: 1.25 cents per point |

September 30 | |

| Chase SapphirePreferred® Card (see Rates and Fees) | Choosing a charity: 1.25 cents per point

Cardholder annual fee: 1.1 cents per point |

September 30 |

| Choosing a charity: 1.25 cents per point | September 30 | |

| Choosing a charity: 1.25 cents per point | September 30 | |

| Aeroplan Credit Card | Travel purchases (up to 200,000 points or $2,500 per year) and cardholder annual fee (purchase fees purchased in certain merchants within 90 days prior to the redemption request date): 1.25 cents per point

In restaurants, grocery stores (excluding Target, Walmart and Wholesale Clubs), home improvement stores, gas stations, select department stores and select utilities: 0.8 cents per point |

December 31 for home renovation stores, natural gas, select department stores and select utilities (dining in restaurants and grocery stores is in progress) |

| United Airlines’ personal and commercial credit cards | Cardholder annual fee: 1.35-1.5 cents per mile (based on the card you own)

Joint ticket purchases are made directly using at least $50:1 cents airline |

December 31 |

| Southwest Airlines’ personal and commercial credit cards | Cardholder’s annual fee within 90 days of transaction date: 1 cent per point | September 30 |

| Marriott Hotel Bonvoy Bold Credit Card | Travel purchases made directly with airlines or Marriott hotels (total of $750 per year): 1 cent per point | Continuous card |

| Disney Credit Card | Purchases made on Disney Parks and Resorts, Disney Stores and Exit Locations, shopdisney.com, shopdisney.com, shopdisney.com, shopdisney.com, shopdisney.com, hulu.com and espnplus.com in the last 90 days: 1 Disney Reward per dollar per dollar

Those who own a Disney® Premier Visa® card (see Fees & Fees) can exchange Disney Rewards Dollars for any airline purchased by the airline, any airline rewards for $1 per dollar |

There is no specific end date in progress |

Information on Chase Freedom Flex, Chase Freedom Card and JP Morgan reserve cards has been independently collected by Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The list of payment charities includes:

- American Red Cross

- Equal Justice Initiative

- Feed the United States

- Glsen

- Human habitat

- International Medical Team

- International Rescue Commission

- Leadership Conference Education Fund

- Willing America

- NAACP Legal Defense and Education Fund

- National City Alliance

- Out and Equal Workplace Advocate

- saint

- Thurgood Marshall College Fund

- United Black College Fund

- UNICEF

- The Road to Union

- World Central Kitchen

Suppose you want to redeem 10,000 points in Chase Sapphire Reserve. For most purchases, you will receive a statement credit of $100 when redeeming 10,000 points.

But for those same 10,000 points, you will receive a $150 credit when you redeem a qualified charitable donation.

Related: How much is Chase Ultimate Rewards Points worth?

Request credit

Getting credit through Chase’s return program requires relatively simple access. Log in to your qualified chase account through the mobile app or desktop and select the “Reward yourself” option in the “Redend” menu.

Next, you will see a list of qualified purchases that you can redeem points. Points can be redeemed for purchases that can be traced back to 90 days.

Assuming you have enough points to cover it, you can offset the full purchase amount.

From there, you can confirm the redemption value and quantity of the points you want and then choose to complete the transaction. Your statement credit should be published within three working days.

Related: How to earn more points with Chase using the store

Other credit options for purchasing

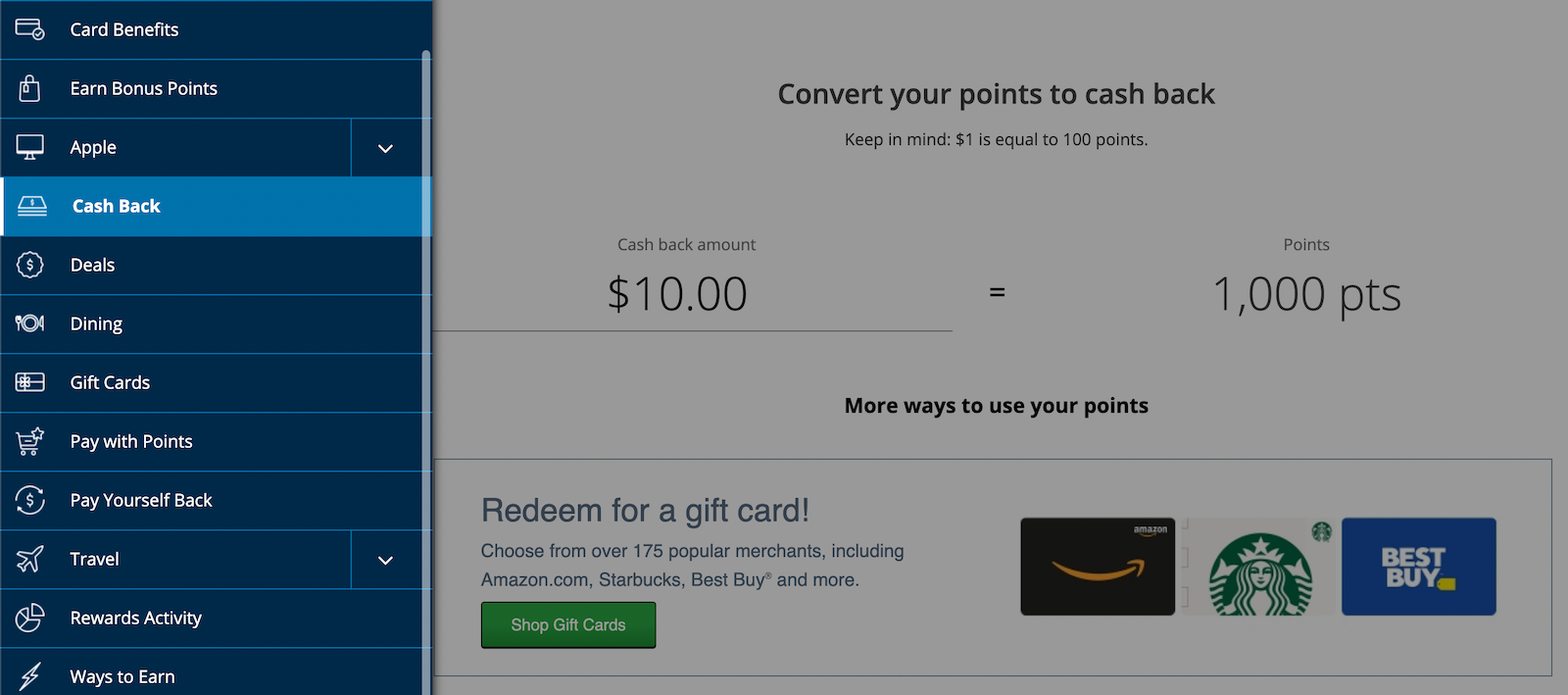

Chase has long offered the option of redeeming points to earn a statement credit – and that’s nothing new. To do this, log in to your final rewards account, click the drop-down menu, and select “Cash Back.”

You will have a choice to enter the amount you want to redeemed and the reward you want to deposit. All cash guard redemptions are set at 1 cent per point, less than half of TPG’s final reward valuation for July 2025, at 2.05 cent per point.

The redemption value is also lower than many of the above repayment options.

Even so, Chase’s traditional cash backpacking options are more generous than what you would expect from other issuers. You get the same value when redeeming Citi Thank You Point cashback, but Amex offers 0.6 cents per point for this option. Capital One appears in the last place, and when redemption cash back, the cardholder’s net worth is only 0.5 cents per mile.

Related: If I cashed in on my points and miles, do I have to ask for taxes?

Bottom line

Chase’s Reple Rack feature provides valuable flexibility for many cardholders. Ultimately, whether you should redeem your balance this way depends on how you intend to use the key points, how much you currently have and whether you benefit greatly from a declared credit.

Related: Enhance your chase ultimate reward balance with these top 5 cards