Gluco Armor Review 2025•Diabetes Reversal? •Real Comments

Do you often feel tired after eating? Do you suffer from midday crash or random craving? Are you worried about blood sugar affecting your weight? vitality? mood? These symptoms may indicate glucose imbalance. Over time, this can affect your health and blood sugar stability. Fortunately, Glucose Armor supply Direct but scientifically supported approach Promote Stable blood sugar levels.

This supplement Strengthen energy, blood sugar and metabolism. It combines modern nutrition with traditional herbal healing. Gluco Armor gives you one Simple, effective path– Whether you want to be healthy for a long time or manage early insulin resistance. The convergence of thousands of trust Gluco Armour 20 carefully selected ingredients.

What is glucose armor?

Glucose Armor It’s one Natural dietary supplements are designed to maintain healthy glucose levels and stabilize blood sugar levels It also supports healthy blood sugar. For those who want to manage glucose levels effectively overall. It provides Consistent, plant-based support to stabilize blood sugar levels and promote insulin sensitivity, supporting overall metabolic balance and cardiovascular health. and 20 powerful ingredients Includes herbal extracts, vitamins and minerals for adults who want 30-70 Gentle, not robbery, easy to swallow Solutions that suit their daily health.

Made in the United States Gluco Armor has helped thousands of people Support healthy blood sugar regulation as a dietary supplement. and glucose regulation while maintaining healthy glucose levels without the need for irritating chemicals, stimulants or restrictive diets. This scientifically supported formula helps protect cells and provides antioxidant protection, is a natural alternative to traditional medicines so you can support long-term health with confidence.

but Gluco Armor is not only suitable for people with blood sugar problems; It also provides effective blood sugar management for those experiencing low energy. After taking this supplement, many people experience low energy, brain fog, poor concentration and weight management difficulties. Care about health and put nutrition in the first place for those who trust glucose armor Ingredients for clinical testing and positive glucose armor review. Diabetes and metabolic syndromes are becoming increasingly common around the world. This supplement promotes insulin sensitivity and is a timely and effective method Maintain blood sugar levels and general metabolic health.

📌Click here to get glucose armor at a discounted price

How does it work?

Gluco Armor solves potential problems This will cause blood sugar to be concerned how Glucose metabolism Absorbed by the intestine,,,,, how Maintain insulin sensitivity and How effective is carbohydrate decomposition. Main ingredients in the recipe are retained Insulin works properly and lower blood sugar to prevent fluctuations throughout the process sky.

Chromium helps insulin better To improve metabolism Magnesium and alphalipoic acid help cells generate energy and support Enzymes that are important for controlling blood sugar. These nutrients can be used Strong antioxidants Protect cells from Oxidative stress caused by high sugar levels. This omnipotence helps improve metabolic efficiency and makes the body easier Decompose sugar and lower inflammation,support Metabolic health and overall health.

Glucose Armor Supported Weight management By helping to control sugar intake and prevent excess glucose from being stored as fat. It can boost your energy, boost your mood, and prevent “Crash and burn“The effect caused by sugar studs. This makes daily activities easier to deal with, especially for those who struggle with Glucose absorptionfatigue, irritability or Craving for sugar. The endocrine system that regulates insulin and other important hormones also benefits from this supplement, promoting Hormone balance and support Carbohydrate metabolism. Used frequently, many people noticed improvements Metabolic functionbetter blood pressure regulation and enhance Glucose controlleading to continuous energy and overall Metabolic health. The system supports not only your blood sugar, but also your entire metabolism. This is safe for long-term use and is effective enough to bring obvious results.

Ingredients: What are glucose armors?

There are 20 carefully selected substances in each capsule Glucose Armor. All of these compounds have been shown by science to help blood sugar support, energy production, key vitamins and cellular functions. Here are some of the most important people:

- Vitamin C – A powerful antioxidant that slows down sugar absorption, helps your body absorb nutrients and strengthens your immune system and overall metabolic health.

- Vitamin E. – Helps keep your heart healthy, speeds up energy metabolism, protects cells from oxidative damage, and strengthens the immune system.

- magnesium – Used to manage blood sugar and participate in over 300 enzymatic functions such as how muscles work and how nerves talk to each other.

- Zinc – Make cells more sensitive to insulin and help the pancreas work better, thereby improving cell health in general. This leads to more insulin production and better glucose uptake.

- Biotin – Help your body break down carbohydrates, turn food into energy, and better control glucose levels.

- chromium – Known for improving insulin sensitivity, reducing fasting blood sugar levels and supporting healthy cholesterol levels.

Together, these substances work to support systems at many levels, help maintain healthy blood sugar levels, improve metabolism, help control weight and support overall cellular health over the long term.

📌Click here to get glucose armor at a discounted price

You can expect the benefits of supporting healthy blood sugar levels

- Supports management of blood sugar levels – Help manage blood sugar levels by keeping blood sugar levels stable and encouraging a fast insulin response to long-term metabolism.

- Stable blood sugar levels – Keep your blood sugar levels normal and stable, which stops sudden spikes and collapses and helps you think clearly and have a steady energy all day long.

- More daily energy – By easily breaking down glucose in the body, the body can enhance energy production.

- Less food – Helps keep hormones balanced, control hunger and fullness, and reduces cravings for candy and food.

- Improve mood and focus – Reduce brain fog and mood swings caused by sugar and improve cognitive performance and emotional control.

- Healthy weight support – Stop excessive glucose being deposited as fat and help fat metabolism better by making the body’s metabolism.

These benefits not only help keep your blood sugar levels normal, but they can also help you stay active, engaged and cognitively alert, which makes it easier to start and maintain a healthy lifestyle.

📌Click here to get glucose armor at a discounted price

Pros and cons

Real customer reviews

“I gave this piece 5 stars. It does everything it claims to do! My sugar dropped from 200 to between 123 and 140. I lost 6 pounds without really changing my diet! If I continued to look at my diet and sugar, I might even have prescription medication. – Sabine G.

“Very happy with the results. My blood sugar is stable and I have more energy. The product is great. I looked up useful plants, vitamins and minerals and started buying them separately, but found all of them included!” – Jonathan S.

Most comments mention improvements in mood, weight and energy. Users like this are all a capsule. Many reports say sugar intake reduces sugar cravings and naturally decreases, which is reflected in the glucose armor review. For others, after years of fatigue and blood sugar problems, it rejuvenates their vitality through natural support. Whether used with dietary changes or alone Glucose Armor Often, measurable results are available in terms of physical and mental health, and free shipping is available.

Side effects and safety

Glucose Armor yes Made of high-quality non-GMO natural ingredients, free of stimulants, artificial preservatives or synthetic fillers. User Report No side effects as directed. It is Suitable for adults of all ages And can help maintain healthy cholesterol levels. Individuals using existing health conditions or prescription medications should consult a healthcare professional before use and can find more information on the official website. The formula is Gentle enough to adapt to most health conditions and diets while supporting nutritional absorption. After GMP (Good Manufacturing Practice), manufactured in a registered facility in the Food and Drug Administration, it meets high safety and quality standards.

Clean labels and transparent procurement make it a priority for those who prioritize health and want to know themselves in the body, including support for immune function.

How to take glucose armor

take One capsule every day. For best results, use 60 to 180 days. Some people prefer to enjoy the energy of the day with breakfast And others will Support overnight metabolic regulations at night.

Simple daily habits make it easy to be consistent, which is the key to getting the full benefit of the formula.

Pricing (2025) and 90-day money-back guarantee

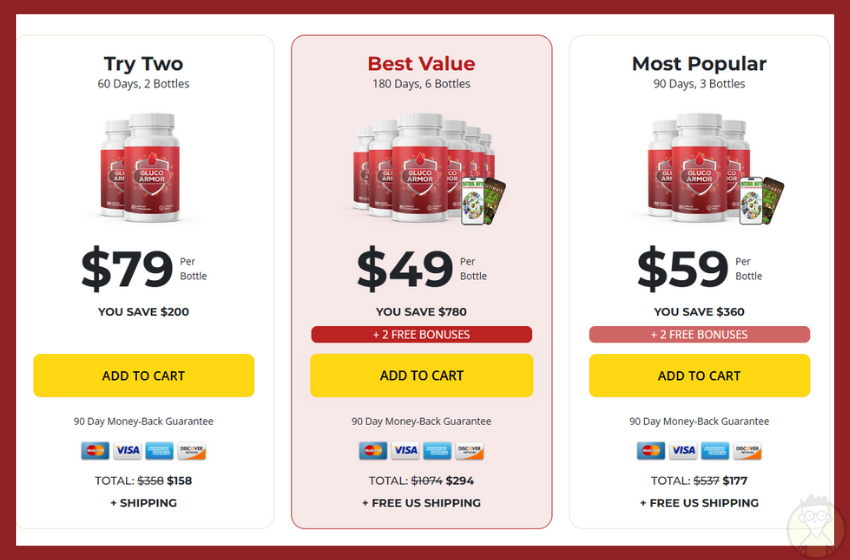

- 2 bottles: $79 per bottle (Total $158) + Shipping

- 3 bottles: $59 per bottle (Total $177) – Free shipping + 2 free bonuses

- 6 bottles: $49 per bottle (Total $294) – Free shipping + 2 free bonuses

Every purchase is 90-day money-back guarantee So you can try free risk.

📌Click here to get glucose armor at a discounted price

>>Related Articles: Glucose Quantity Review 2025: Natural Balance of Blood Sugar

Where to buy: Official website

Glucose Armor yes Available on the official website only. Buy directly Make sure you get real products, bonus materials (if applicable), and exclusive pricing is not available elsewhere.

This is The safest way to avoid counterfeit or expired products and unauthorized sellers. Buyers also receive customer support, shipping updates and secure checkout.

Final judgment: Is Gluco Armour worth it?

The expert of stupid little man Review Glucose Armor And call it Breakthrough in blood sugar support. Its powerful antioxidant ingredients are more than just a quick fix. They help restore insulin function and balance metabolism. Also a formula Strengthen energy, focus and emotions. Unlike temporary solutions, it works with your body over time.

This supplement combines modern research with traditional Ayurvedic medicine. Glucose Armor Provides a natural long-term health approach to blood sugar. Although daily use and online access only may seem inconvenient, thousands of users have reported positive results. Additionally, the 90-day money-back guarantee adds extra confidence.

If you want better energy, focus and metabolic control, Glucose Armor Provides avenues for research support for overall health.

📌Click here to get glucose armor at a discounted price

>>Related Articles: Sugar Balance Review 2025: Is it really effective?