Retrospectively eliminated the myths around Bas Jan Ader

Kill a myth in your danger, and the miracle of destruction will not come back.

That’s a way to see it. Another is: One miracle can squeeze out another miracle, and sometimes the most important job of a curator is to remove debris. It is not that the old miracle is garbage, but that it hinders the passage. Few people will be frustrated by the efforts of hamburger Kunsthalle.

Therefore, the biography of the artist is “In Winschoten, the Netherlands in 1942, on standby at sea in 1975”. Ader’s death in a weird attempt to cross the Atlantic Ocean alone on a small sailboat, a middle performance of a triptych that begins with a night walk filmed in Los Angeles and completed by wandering around the night in Amsterdam, which is just a tragic accident. Although this work is called Looking for miraclesAlthough the performance of the cause is impossible, and while the trip seems to have spent himself in a career with natural forces, Kunsthalle goes out of his way to insist that Ader’s final work is absolutely impossible to be regarded as his final work, the most authentic conceptual artistic acts are not necessarily the conferredness of the self.

These efforts are in the catalogue, the curator’s introduction video, and especially in a room dedicated to the legendary unfinished works, which emphasizes the meticulous preparations of the trip and Ader’s previous experience in sailing, and includes a completely secular archive of pragmatism: regulations, configurations, configurations, tools, tools, maps.

Therefore, the exhibition brings Bas Jan Ader back, not from death to life, but from the sea and back to the shore. Or, flip your geometry: it pulls the man out of the ether of the artistic mythology and returns to Earth. Since the Earth is the most interesting work Ader does, if it’s a pretend to be ideal, then it’s also a suitable landing on the ground.

After all, he is a gravity artist.

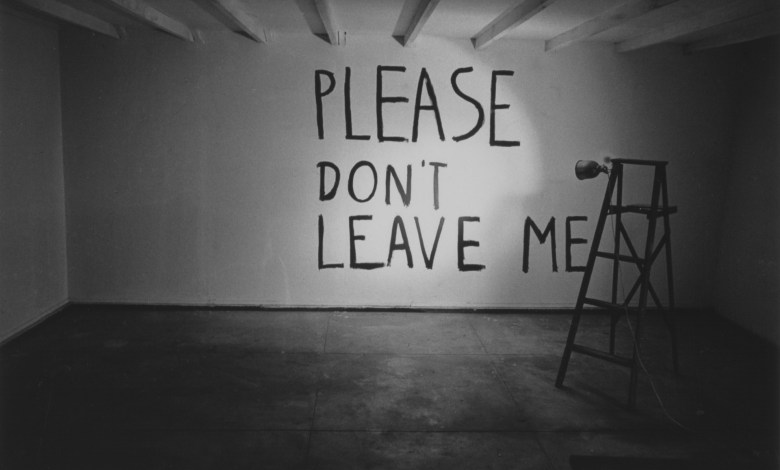

Bas Jan Ader: I’m so sad to tell you1970-71.

©Bas Jan Ader’s estate. Courtesy of Meliksetian Briggs, Dallas

Consider his 1972 performance Boy falling to Niagara Fallswhere Ader reads a story aloud Reader’s Summary About a boy’s survival falling on a waterfall. Or photo series On the road to new plasticism, West Capel, Netherlands (1971), in which Ader twists his limbs into allowable linearity and prohibits the diagonal form of Mondrian, Domburg Lighthouse Tower in the background, puts his body on bricks, with yellow oil cans, with red boxes, with red boxes. Companion photos, Trap on the way to new plasticism (1971), throwing the body, cloth, cans and boxes into the blurred chaos. Here, the ground is a stable canvas of fixed geometric forms, and is also a barrier to its fixity.

Another type of gravity suggests that it is one of Ade’s most famous works, 1970 I’m so sad to tell you– A three-minute and a half-minute face shot, with tears spreading open, covered with painful pain. Through the line is sadness and gravity, both from gravity,heavy.

Ader’s death ruled his life precisely because it was too short. He produced the most important works between 1970 and 1973. What should you do if you have shown such an aesthetic promise in such a short time? This is Jeff Buckley’s problem. Youth and elimination are very important. For Ader, Kunthalle brings together impressive material: previously unverified early drawings, shows from student programs, letters and postcards, handwritten instructions. Together with a beautiful catalog, the gathering allows for a rich exploration of the corpus and commitment. Interested parties can consider the relationship between Ader and Light, Masculinity, De Stijl and Concept Art.

Hamburger Kunsthalle’s 2025 exhibition “Bas Jan Ader: I’m searching…”

But the question is: What are you finding in exhibitions that you can’t encounter in all these documents? If there are traces of long-term action, isn’t that part of what we want to fall under a miracle with a miracle desire, is it a desire to experience something unquestionable?

You have to look for it, but here is a map. Adventure to the farthest corner of the crazy room, after a reenactment Objects with weak light are threatened by eight pieces of cement. Keep going, you don’t see the sign, but keep searching. It’s there, your little, hunted stuff.

Four 16mm projectors pass through the center of a long dark rectangular room, their drilled holes filled with air. Each does one work on the wall: Fall 1, Los Angeles; Autumn 2, Amsterdam; Broken Autumn (Geometry), West Capel – Netherlands; Broken Autumn (Organic), Amsterdam BOS – Netherlands. They were made in 1970 and 1971 and ranged from 19 to 109 seconds. The described uses are limited. It is not fair to know that they involve Ader’s body rolling down from the roof, overflowing on the bike to a canal, tilting diagonally, falling from branches to streams.

Hamburger Kunsthalle’s 2025 exhibition “Bas Jan Ader: I’m searching…”

©Bas Jan Ader’s estate. Courtesy of Meliksetian Briggs, Dallas

“I don’t make body sculptures, body art or body works,” Ader insists. “When I fell off the roof of the house or entered the canal, it was because gravity made me my master.”

But, like Beckett’s suggestion, death does not require us to remain free for a day, and gravity does not require our consent to be subject to its force. In his waterfall, Ade makes himself vulnerable to the damage he has been hurt by his prey. People see the beautiful prec province of isolated, slowing down, nervous, controlling, restraining changes to pause the ridiculous project for as long as possible. But the pressure always breaks and the body gives way. In vain, this resistance: everyone failed.

Ader’s is the corpus of verbs: not tears, cry; not ledge, fall. These loop movies live in the noisy darkness, and people see ordinary miracles of life. Maybe not as wonderful as the old myth, but just as beautiful.