Chase Over Time and My Chase Loans: The Final Guide

The golden rule of credit cards and rewards is that we should strive to pay the balance in full every month. A large amount of interest rate bank charges (especially on travel reward cards) will quickly strip away any value you may earn from points and miles. Sometimes unexpected expenses may occur, or the balance cannot be repaid due to economic emergencies or poor planning.

Chase offers two financing options for credit card fees: Chase Payment over time and my Chase Loan. Each fee comes with its own fee or interest fee, which is usually less than your regular annual percentage (APR) and can help cardholders pay off bigger purchases within a few months.

In this guide, we will take a detailed description of Chase loans over time to help you better understand what they are and that these financing options are for you.

Chase over time

Chase Pay is one of two financing options available for most consumers chasing credit cards over time, e.g. Chase SapphireReserve® (See rates and fees) and Chase for Freedom® (See rates and fees).

This was formerly called “My Chase Plan.”

How much does Chase pay over time?

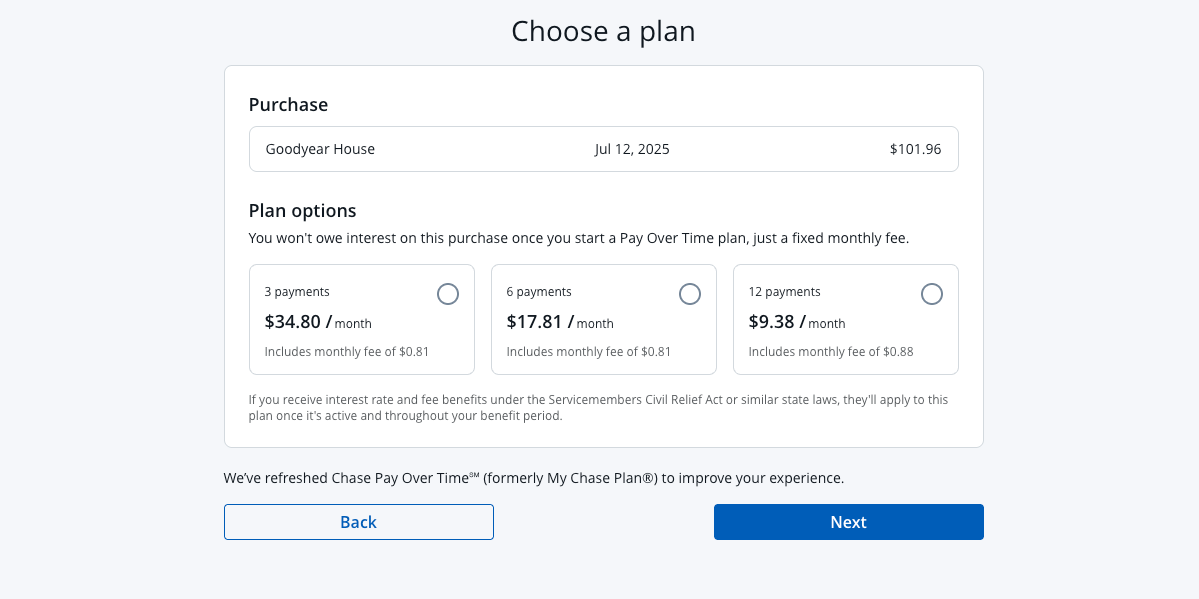

Over time, Chase Pay is similar to the American Express plan IT® feature, and Chase Carddolder can repay $100 or more of a purchase on a monthly fee without interest in a selected number of months.

Chase monthly fees can be as high as 1.72% of each qualified transaction. The fee varies depending on factors such as the amount of funds raised and the duration of the repayment plan you selected, but is usually less than any interest expense you just assumed for the balance.

Chase cardholders can have up to 10 plans on their account at any time. Sometimes Chase offers a monthly fee of $0 for on-time schedules; this is the best time to choose payment over time.

How does Chase pay over time?

Over time, Chase Pay allows cardholders to fund eligible purchases by using existing credit cards and credit limits without transferring the balance to the balance transfer card.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

Depending on the purchase amount, Chase can offer repayment terms for three to 18 months. When selecting a payment time plan, the cardholder will provide three repayment option options.

While you won’t charge interest on the balance you carry monthly, Chase usually charges a monthly fee to recruit Chase Pay Airloct Tair. The planned monthly amount is added to your minimum balance, so to ensure you pay off your purchase, the cardholder must pay at least the minimum balance of their card per month.

Over time, Chase’s pros and cons

| advantage | shortcoming |

|---|---|

|

|

TPG Credit Card Editor Olivia Mittak recently used his salary over time to buy a sofa with an 18-month plan. She uses her United ℠Explorer Card (See Rates and Fees), this is a common Chase United card.

Amazon checkout

Chase cardholders also have the option to use a $50 or more payment at checkout on Amazon.com. When you select a Chase card, you can select “Available Financing Offers” during checkout to view your options.

You can choose the schedule duration and pay with a fixed APR, which is the same or low as a regular APR.

Related: Buy Now, Pay Later with Credit Card Rewards: Which Should You Choose?

My Chase Loan

My Chase loan allows cardholders to borrow money from their chase cards from their existing credits and is a better way to borrow money instead of cash payments.

What is my chase loan?

My Chase Loan allows you to deposit your loan into a checking account without fees and the APR is relatively low.

This is an effective way to borrow funds from your existing credit line without having to apply for a loan from another bank, which will also provide you with hard-working advice on your credit report.

How does my chase loan work?

You can set up my Chase Loan online on Chase.com or on the mobile app.

The minimum amount you can borrow is $500. The maximum loan amount depends on your reputation and other factors, including account history.

Chase offers 12-month to 24-month loan terms; once the plan is selected, the funds are deposited into your account within two working days.

Each month, your minimum balance due will reflect your monthly payment for Chase loan and the minimum payment purchased in the previous billing cycle. Pay off my chase loan early without a fine.

Pros and cons of my pursuit of loan

| advantage | shortcoming |

|---|---|

|

|

Will Chase pay over time or will my chase loan affect my credit score?

In short, yes. Although you still have no credit inquiry when using Chase over time or when I chase my loan, you are still using the credit line and paying it off over time.

With a credit card, credit utilization and debt are two key factors in determining your credit score. If your credit line is $20,000 and you are leveraging $10,000 as my chase loan, you will take advantage of 50% of the overall credit line of the card.

The same goes for payment over time: even if you don’t charge interest, paying your card slowly, still indicates that the credit bureau you have a month’s debt.

If you have my Chase loan and the multiple payment plan activated in your account, you will owe more debts per month, which may cause your credit score to drop.

No matter which credit score drops, you may encounter temporaryness in any financing because your overall credit utilization will decrease when you pay off your debt and you will continue to show on-time payments.

Related: Is 30% credit card utilization a magic number?

Chase will pay over time, is my Chase loan worth it?

This option makes the most sense if you can afford to pay back your purchases on time and in full, thus avoiding interest and expenses. But for large purchases that you know you won’t be able to pay off your balance in full, Chase payments and my chase loans may be a low-cost option over time rather than carrying balances and buying interest.

If you are targeted with a no-fee offer, it is worth it to use Chase salary over time over time. In this case, you will have more time to repay the purchase without charging a fee. The only downside in this case is that your credit utilization may increase when you repay the payment time plan.

If you want to avoid interest and fees, another option is APR Credit Card 0%. Many top cashback credit cards offer 12 to 18 months introductory periods that you can still buy with a 0% APR (although once the introductory period is over, the variable APR will apply to your balance).

For those who are very large-scale purchases, if you want to use a credit card to raise funds, a 0% APR card may be a better approach. That said, if you can’t get 0% APR card approval, payment is a viable option over time.

Related: Pros and Cons of 0% APR Credit Card

Bottom line

Funding options such as over time and my Chase loans, options like Chase payments can be a good option as they allow you to pay for purchases over time without paying interest.

Nevertheless, try to avoid needing as many of them as possible. Borrow responsibly and pay off debts within allocated time to avoid fines and damage to credit scores.

Related: Here’s how to merge and repay debts