Which credit card should I use when checking into a Hilton hotel?

If you’re a Hilton loyalist looking for the best card to use on your next stay, you have plenty of options.

The American Express co-branded card is a great place to start. These cards offer high earn rates on Hilton bookings and free elite status during your travels.

But you may want to earn transferable reward currency or take advantage of other loyalty programs. Luckily, we’ve rounded up a list of seven credit cards worth considering for your next stay at Hilton.

Compare Hilton’s credit cards

| Card name | Welcome offer | Hilton hotel revenue | Bonus value per point* on Hilton bookings | Enjoy credit card benefits when you stay at a Hilton hotel** | annual fee |

|---|---|---|---|---|---|

|

Earn 175,000 bonus points after spending $6,000 in purchases within the first six months of card membership. Offer valid until January 14, 2026.

|

34 points per dollar (14 points on card, plus 10 Hilton Base Points and 100% Diamond bonus) |

17 cents |

|

||

|

Earn 155,000 bonus points when you spend $3,000 in purchases within your first six months as a card member. Offer valid until January 14, 2026.

|

30 points per dollar (12 points on the card, plus 10 base points for Hilton membership and 80% Gold membership bonus) |

15 cents |

|

||

|

Earn 175,000 bonus points when you spend $8,000 in purchases within your first six months as a card member. Offer valid until January 14, 2026.

|

30 points per dollar (12 points on the card, plus 10 base points for Hilton membership and 80% Gold membership bonus) |

15 cents |

|

||

|

Earn 100,000 bonus points after spending $2,000 in purchases within the first six months of card membership. Offer valid until January 14, 2026.

|

19 points per dollar (7 points on the card, plus 10 base points for Hilton membership and 20% Silver membership bonus) |

9.5 cents |

|

||

|

Earn 125,000 bonus points after spending $6,000 within three months of account opening. |

Earn 4 points per dollar when booking direct (8 points per dollar when booking with Chase Travel℠ (including The Edit))

|

8.2 cents (or 16.4 cents) |

None (unless you book a Hilton stay through The Edit portfolio, which offers premium benefits like free breakfast and a $100 property credit)

|

$795 |

|

|

Earn 40,000 bonus points after spending $3,000 in purchases within the first six months of membership. |

3 points per $1 |

6 cents |

without any |

$150 |

|

|

Earn 60,000 bonus points when you spend $4,000 in purchases within the first three months of account opening. |

3 points per dollar (10 points per dollar if booking through cititravel.com) |

5.7 cents (or 19 cents) |

without any |

$95 |

*Reward value based on TPG’s November 2025 valuation, not the card issuer

** Certain benefits require registration

American Express Green Card information is independently collected by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Which card should you use?

Now that you know the credit cards we recommend for Hilton bookings, it’s time to break down the factors you should weigh.

There are two main considerations here:

- Hilton-related benefits available during your stay

- How many points you can earn on your booking

Reward your inbox with the TPG daily newsletter

Join over 700,000 readers and get breaking news, in-depth guides and exclusive offers from TPG experts

Let’s break these two aspects down further.

benefit

Here’s a key consideration: If you have a Hilton co-branded American Express card, you’ll enjoy elite status benefits regardless of whether you pay with that specific card.

For example, you don’t have to use Hilton Asbai Hotel Enjoy diamond-level treatment. When you book directly with Hilton, your status is attached to your Hilton profile regardless of payment method.

Two notable exceptions are if you choose to book through the issuer’s travel portal, e.g. using Sapphire Reserve Via Chase Travel or Ground floor apartment Via Citi Travel Portal. These typically count as third-party bookings, rather than direct bookings, and you don’t receive elite status benefits.

Yield

At first glance, it’s clear that the co-branded American Express card earns the most points for your Hilton stay. That said, it doesn’t mean you’re getting the best value.

TPG’s November 2025 valuation puts Hilton Honors points at a relatively low value of 0.5 cents each. This is especially true when you compare that currency to the potential value of transferable bonus points.

Transferable rewards are more flexible and therefore have a higher potential value. Chase Ultimate Rewards points you earn through Sapphire ReserveFor example, based on TPG’s November 2025 valuation, each point is worth 2.05 cents. TPG’s November 2025 valuation also estimates that American Express Membership Rewards points are worth 2 cents each, which is what you’re paying for with Amex Green.

Of course, if you want to keep it simple and earn as many Hilton points as possible, co-branded cards with sky-high earn rates are your best bet.

Still, you have to consider which currency you want to earn and how many points you’ll earn. Think about your upcoming trip and which locations would be most useful for booking a trip. If you plan to stay at a Hilton hotel, you can pay with a Hilton card. In the meantime, if you want to book a business-class flight, it’s best to pay with a card that earns Chase Ultimate Rewards points.

Other considerations

There are other factors to consider when choosing a credit card for your next Hilton booking.

If you’re working toward a card’s welcome bonus, you’ll want to spend the majority of your money on that card to avoid missing out on the offer.

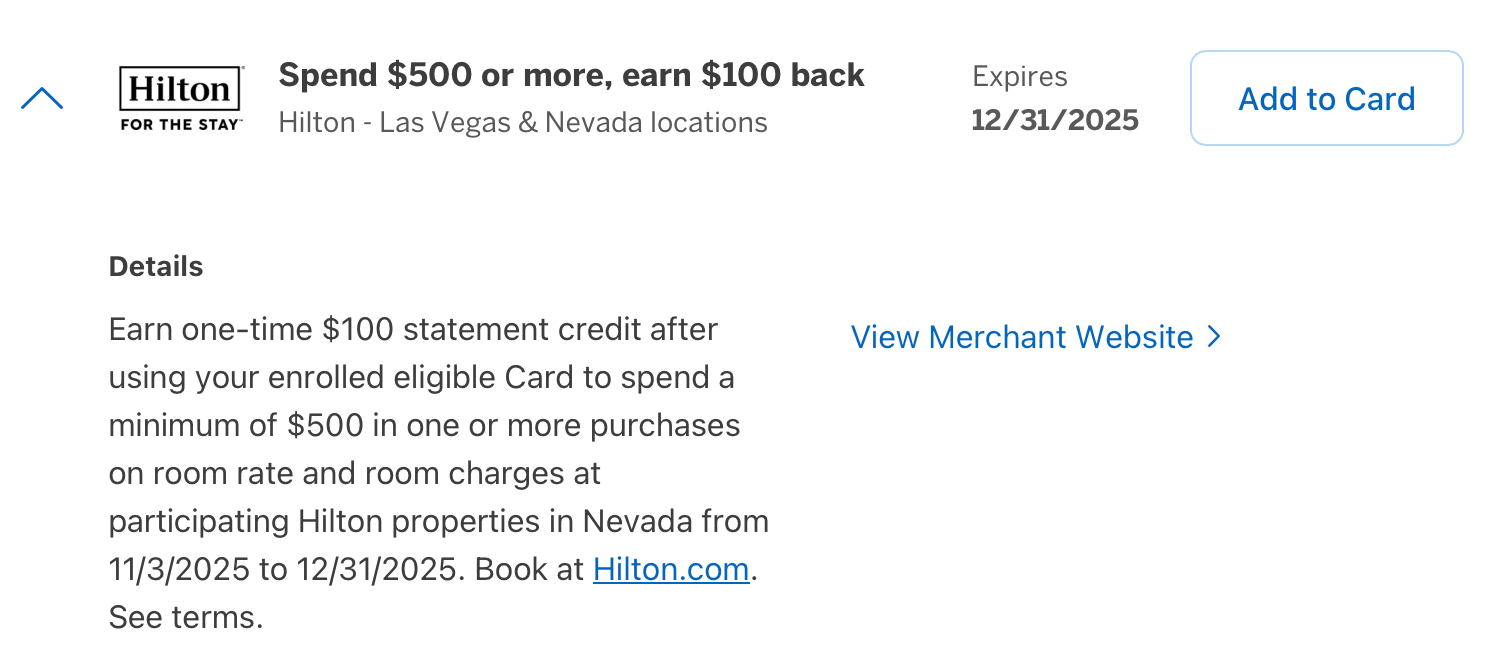

We also recommend checking out American Express Card Deals and Chase Card Deals to see if there are any relevant discounts or offers when you stay at Hilton. You will need to register your target offer and use the relevant card (if this is the option you choose).

Finally, don’t forget to use your Hilton statement points on some co-branded American Express cards. Since many of these benefits are earned quarterly or semi-annually, keep track of which cards offer Hilton discounts so you can maximize the full value of your card benefits. Some Hilton cards also offer annual spending bonuses that can earn you higher elite status or additional free night credits.

Related: Maximizing Your Rewards: Your Points and Miles Checklist

bottom line

There are pros and cons to any decision. If you’re a Hilton loyalist, it’s usually best to pick up a co-branded card and pay with it.

But if you value transferable rewards and want to grow your balance, we have flexible options, including some of our favorite travel rewards cards.

As long as you’re taking advantage of credit card offers and earning redeemable rewards, you’ll be ahead of the game.

RELATED: Current Welcome Bonuses for the Hilton American Express Card

For Hilton Aspire Amex rates and fees, please click here.

For Hilton Surpass Amex rates and fees, click here.

For Hilton Business American Express Card rates and fees, click here.

For Hilton American Express Card rates and fees, click here.