Foreign Trading Guide: What to Know

At TPG, few things can frustrate us, not unnecessary fees, and foreign transaction fees are at the top of the list.

You may have noticed that when you use certain credit cards abroad (or on unhosted sites in the United States), each purchase increases the fee.

Let’s discuss how much these costs are and how to avoid them in the future.

What is a foreign transaction fee?

When you do the processing through an overseas bank to process a transaction, foreign transaction fees are charged on certain cards.

When you are traveling or making a purchase through a foreign website, the bank may convert the transaction amount to USD – usually marked. Some credit card issuers then pass this conversion cost to the consumer as a foreign transaction fee.

Related: Best Commercial Credit Cards Without Foreign Transaction Fees

How much is the foreign transaction fee?

The standard foreign transaction fee tends to be about 3%.

Visa and MasterCard usually charge a 1% processing fee, and many U.S. banks pay an additional 1%-2% fee.

However, Capital One and Discover have zero foreign transaction fees in all of their credit cards.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

Which cards do not have foreign transaction fees?

Most top travel reward credit cards do not charge foreign transaction fees. In fact, it is rare for cards that charge any foreign transaction fees for providing travel rewards and privileges. After all, it would be counterintuitive to a card sold for a sales card that charges an international purchase fee.

While some issuers charge about 3% foreign transaction fees for certain products, you should consider Capital One or Discover Cards because they do not charge foreign transaction fees.

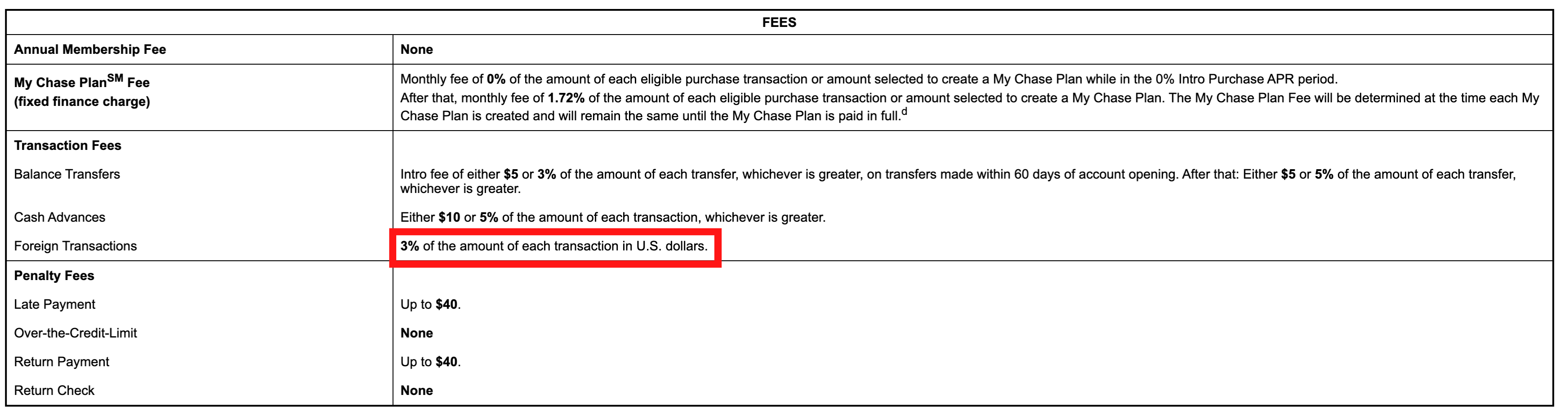

The card issuer must enable potential customers to obtain interest rates and fees associated with the credit card, including foreign transaction fees. Check the terms and conditions of your credit card to see if your card (or the one you are considering applying for) charges for foreign transaction fees.

The rates and fee schedules usually explicitly list foreign transaction fees in the Fees section.

Related: How to choose a credit card without external transaction fees

Foreign transaction fees and ATM fees

Another kind of fee you may hear while traveling is the foreign ATM fee. Although these two fees can be applied when traveling outside the United States, they are not the same.

When you withdraw cash from an ATM abroad, you will be charged a foreign ATM fee. Some banks give up on this fee, especially if you use an ATM that belongs to a specific bank network.

Additionally, you may be required to pay additional fees when using the ATM abroad, including a fixed fee for the bank to use the ATM associated with the bank (usually usually USD 5), a foreign currency conversion fee (usually 3% for foreign transaction fees) and an additional transaction fee charged by the owner of the specific ATM you are using. As you may see, multiple withdrawals during a trip can easily add up.

This is one of the reasons why we recommend using a credit card to pay when possible. But in some places, cash is still king, and you need to create a game plan that avoids this type of expense, or include it in your budget.

TPG credit card writer Danyal Ahmed recommends using the Schwab Bank high-yield investor checking account, which offers unlimited ATM fees to repay domestic and international revocations.

Related: Tips for saving overseas ATM withdrawals

How to avoid foreign transaction fees

Use a card without foreign transaction fees

The easiest way to avoid foreign transaction fees is to use a card that is not charged. TPG has regular updated guides on top credit cards, no foreign transaction fees, which can help you choose the best travel card.

However, some popular cash reserve cards, such as Chase FreedomUnlimited® (see Fees and Fees) and Blue CashPreferred® Card for American Express (See rates and fees), tend to charge foreign transaction fees.

Related: Pros and cons of cash backing credit cards

Avoid “dynamic currency conversion”

When using a card terminal abroad, you may be prompted to pay in local currency or US dollars. You should always choose your local currency.

Dynamic currency conversion is a sneaky way, and banks encourage you to pay abroad. However, they usually give you a poor conversion rate, so it is best to pay in Euro, Peso or local currency.

Related: Dynamic Currency Conversion: What It Is And Why Should You Avoid It

Pay in cash

Of course, you can also avoid foreign transaction fees by making payments in cash.

However, cash purchases won’t bring you rewards, and withdrawing cash abroad can be subject to annoying fees.

Bottom line

The good news is that among top credit cards, foreign transaction fees are much less than before. It seems the industry is gradually moving away from charging customers these types of fees.

Before this, check the terms and conditions of your credit card to see if you will charge when traveling – and plan your card usage accordingly.

To avoid foreign transaction fees, select a top travel reward card or any card from Capital One or Discover. Also, always use your credit card instead of USD to avoid poor conversion rates to pay in local currency.

Related: How to Choose the Right Travel Credit Card for You

For Amex Blue Cash preferred rates and fees, click here.