Marriott Hotel Bonvoy Unlimited Credit Card Review: Full Details

Marriott Hotel Bonvoy Unlimited Credit Card Overview

Even if you are not a big Marriott fan, it is worth considering the BonvoyBoundless® credit card (see Fees & Fees). It comes with annual free nights and elite night points, but it has a lower annual fee than most other cards in the Marriott Solitaire lineup. Card rating*: ⭐⭐⭐

*Card ratings are based on the opinions of TPG editors and are not affected by the card issuer.

Marriott offers a variety of credit card portfolios issued by Chase and American Express. However, the Marriott Bonvoy Bonvoy Unlimited Credit Card from Chase stands out and is the only mid-level individual Marriott hotel available to new applicants.

The annual fee is $95, the recommended credit score is $670 or higher, and the unlimited land is just above the lowest level Bonvoy Bonvoy Bold® credit card (see interest rates and fees). Even those who don’t stay at the Marriott hotel often can benefit from this card’s valuable welcome bonus, annual free nights and elite night points.

Let’s take a closer look at whether Marriott’s Bonvoy Boundless might be a good addition to your wallet.

Bonvoy’s unlimited pros and cons

| advantage | shortcoming |

|---|---|

|

|

Marriott Hotel Bonvoy Unlimited Welcome Discount

For a limited time, new applicants at Bonvoy Boundless can earn five free nights (worth up to 50,000 points per night and total potential value up to 250,000 points) and purchased $5,000 from account opening in the first three months. Some hotels have hedging fees.

TPG’s June 2025 valuation PEG Marriott Bonvoy points are 0.7 cents, and if you fully maximize it at 50,000 points (total 250,000 points) per night, the bonus is worth up to $1,750.

This matches the highest welcome bonus we see on this card, which is usually offered once in the first half of the year. If you are considering adding this card to your wallet, now is the best time to apply.

It is also important to pay attention to the qualification requirements for this card:

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG experts

- To get approval, you need to follow the Chase 5/24 rules because this card is issued by Chase.

- Additionally, Marriott’s co-branded cards are known for their strict and somewhat chaotic qualification requirements, and unfortunately, unlimited rules are subject to them.

Be sure to check the eligibility requirements before submitting your application. These eligibility requirements usually require you not to receive a welcome bonus on another Marriott or former Starwood priority guest credit card for a period of time. Additionally, if you are currently holding millions of Cobrand cards, you may not be eligible for a welcome bonus now.

Related: A complete guide to Marriott Hotel Loyalty Program

Marriott Bonvoy Unlimited Benefits

Bonvoy Boundless comes with an annual fee of $95, but getting hundreds of dollars worth of each year from the card’s privilege should be easy. Here are the main cases to consider:

Free Anniversary Night Award

Each year, you will receive a free night certificate up to 35,000 points based on renewal. You can also earn a certificate with up to 15,000 extra points, making it worth 50,000 points.

TPG’s June 2025 valuation sets the value of 35,000 Marriott points at $245, almost three times the $95 annual fee. However, if you choose to redeem the reward night, you have the potential to get greater value.

“I found out that my unlimited card is actually self-free because the annual free night rewards quickly paid $95. To add, it’s a fact that helps you earn a lot of points on every dollar spent, and I was able to use a certain amount of membership, including a nighttime home in a hotel, and I was able to make money at a certain rate, when I could get a busy person in a hotel, a family, a restaurant, a family home, a family home, a family home, a family home, a family traveler, a family home – see Taylor Swift.”

Elite identity

With Bonvoy Boundless, you get an automatic silver elite status, which comes with 10% bonus points for stays and priority checkout.

The card also offers a way to reach the Golden Elite status: it costs $35,000 per calendar year. However, if you want a card that offers free Golden Elite Identity at Marriott, consider PlatinumCard® from American Express or BusinessPlatinumCard® from American Express (registration required; term applicable).

While you can unlock Gold Elite status by paying out, you’d better earn higher status organically with free 15 Elite Night Points on your card and book directly with Marriott. So, for the unlimited 15 nights, you only need to keep it for 35 nights (rather than 50) to get Platinum Elite identity.

If you have a Bonvoy Boundless and Marriott business card, such as the Marriott Bonvoy Business® American Express® card, you only need to earn 30 Elite Night Points from your credit card a year, and only 20 nights will arrive at Platinum Elite.

Another way to higher status is to earn an Elite Night Point for every $5,000 spent on a purchase on a card using it.

Other privileges

The above benefits represent a few hundred dollars in value each year and can easily compensate for the annual fee of $95. But the card also offers some other allowances:

- Luggage Delay Insurance: If the passenger carrier delays the luggage by more than six hours, Chase may repay you for five days of essentials for up to $100 a day.

- Reimbursement of lost luggage: If the passenger carrier damages or loses your check or carry-on luggage, Chase may provide up to $3,000 for each of your covered travelers.

- No foreign transaction fees: This allowance makes Bonvoy unlimited and perfect for buying and booking hotels around the world.

- Purchase protection: Chase covers most new purchases within 120 days to prevent damage or theft, with up to $500 per claim (up to $50,000 per account).

- Travel delay reimbursement: If you delayed more than 12 hours or stayed overnight while traveling with a public carrier, Chase may choose your choice, otherwise no fees will be required, up to $500 per covered traveler.

Related: Free Nights and Simple Status: Why I Have 3 Marriott Bonvoy Credit Cards and Pay Annual Fee Over $1200

Win unlimited points at Bonvoy at Marriott Hotel

Marriott Hotel’s Bonvoy Boundless card earns points at the following rates:

- 6 points per dollar spent on hotels participating in the Marriott Hotel program (you will spend up to 17 points on a qualifying Marriott hotel: 10 points earning Bonvoy members, 6 points for the card, 10% bonus points from Silver Elite Status, the card offers a return equivalent to 11.9% of the reward price for 11.9% return, returning tttt the Check the the the June 205, 205, 205.

- The first $6,000 spent annually at restaurants and gas stations and grocery stores, 3 points per dollar

- Spend 2 points per dollar on all other purchases

The reward points you earn can be valuable thanks to the free elite identity that comes with this card – especially if you promise to win Marriott Bonvoy points.

However, other cards such as Chase SapphireReserve® (see Fees & Fees) can give you a better return for Marriott hotels.

Related: The best way to earn a Marriott hotel: From hotel accommodation and credit card spending to travel partners

Marriott Hotel Redemption Point

Of course, the most obvious way to redeem a Marriott hotel location is hotel accommodation. There are some strategies to maximize your Marriott redemption, but it’s the easiest.

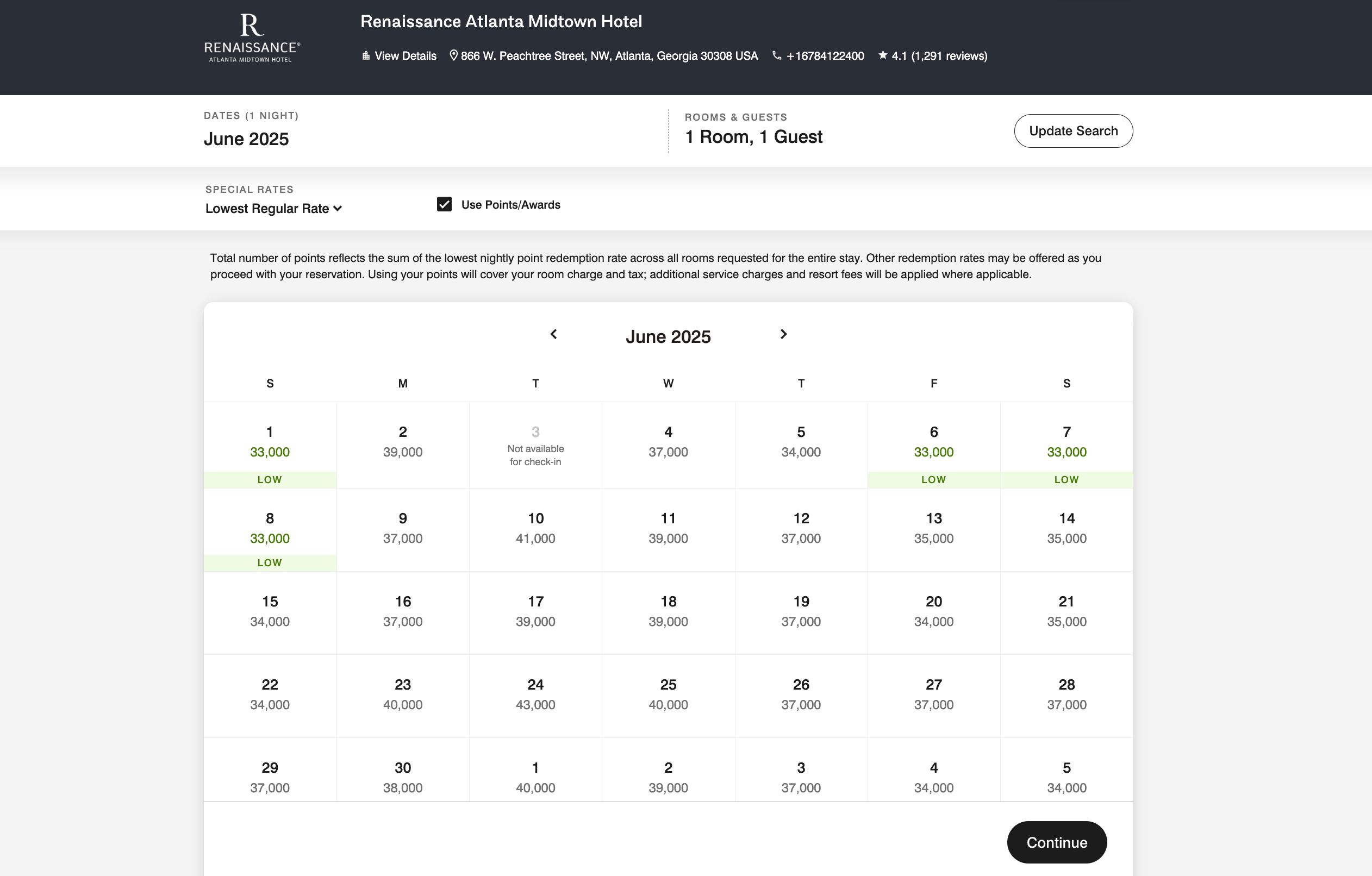

Marriott Bonvoy uses dynamic pricing for its reward nights, which means redeeming the number of points required for a given demand and availability.

Use Marriott’s bonus calendar search feature to help you find the best deals when redeeming points. For example, a Renaissance night in Midtown Atlanta can be as low as 33,000 in the first week of June, but as high as 43,000 per night after this month.

The redemption rate at Marriott Property also fluctuates based on the brand you leave behind. For example, a night in Paris at Gare de Lyon, which is centered on a business traveler, may require 65,000-68,000 points, while the luxurious St. Regis Bora Bora Resort is 128,000-140,000 per night.

Another important factor to note is that you need to make use of the fifth night as free as possible (called “stay 5, pay 4”). You stay at the Marriott Hotel for five consecutive nights and you will get free points for the night. This is a powerful way to extend your point of view further over a longer period of time.

TPG credit card writer Chris Nelson used the five nights of cheering up in his Aloft Bali Seminyak accommodation, where he redeemed only 50,500 for a total of five nights.

Related: Maximize your hotel points with free 4th or 5th nights

Transfer points for Marriott Hotel

Marriott Hotel allows you to transfer points to nearly 40 airline partners, including some hard-to-surpass currencies such as Frontier Airlines and Korean Air. Most transfers have a ratio of 3:1, with 5,000 miles per 60,000 points.

While this may be useful for selling or booking reward flights in your account, it is usually not the best use for Bonvoy points, especially since most transfers take several days and the reward space may disappear before the transfer is completed.

TPG credit card writer Danyal Ahmed uses his Bonvoy points to follow his American Airlines Aadvantage account, requiring additional miles to do high-value redemptions, such as on the award-winning Qsuite of Katar Airways.

Related: Marriott Bonvoy Plan: How to Redeem Hotel Accommodation, Air Tickets, etc.

Which cards compete with Marriott’s Bonvoy unlimited?

If you want more Bonvoy Marriott Perks or more flexible rewards, you might find that one of the cards is a better match:

For additional options, check out our full list of Bonvoy credit cards and Best Hotel Credit Cards for Best Marriott Hotels.

Related: 3 Reasons Why Bonvoy Lobenless is Worth the $95 Annual Fee

Bottom line

Bonvoy Boundless at Marriott offers an annual fee of $95, and privileges can often be found on more expensive cards, such as a free night worth $200 to $300 a year.

This is great for Marriott fans who want to avoid high fees, but be aware of strict bonus rules and Chase’s 5/24 restrictions.

If you have completed Chase Trifecta and qualified for bonuses, this card may be a wise addition to your wallet.

Apply here: Bonvoy Bonvoy Unlimited Credit Card

For rates and fees at Bonvoy Brilliant Amex, click here.

For rates and fees at Bonvoy Bevy Amex, click here.